EUR/USD Downside Intensifies as ECB Cuts Loom, Global Headwinds Mount

EUR/USD has broken to a 7-month low, and downside risks are likely to persist as market focus shifts toward the possibility of deeper ECB rate cuts. Expectations for the ECB to adopt a more dovish policy stance stem from rising concerns over economic pressures within Europe and abroad. President-elect Donald Trump’s likely hawkish trade stance, especially if a hard-liner takes the role of U.S. trade representative, has kept EUR/USD under pressure. Additionally, China’s upcoming CPI and PPI data could underscore a sluggish economic recovery, posing risks to European growth, especially as German elections loom, adding further uncertainty.

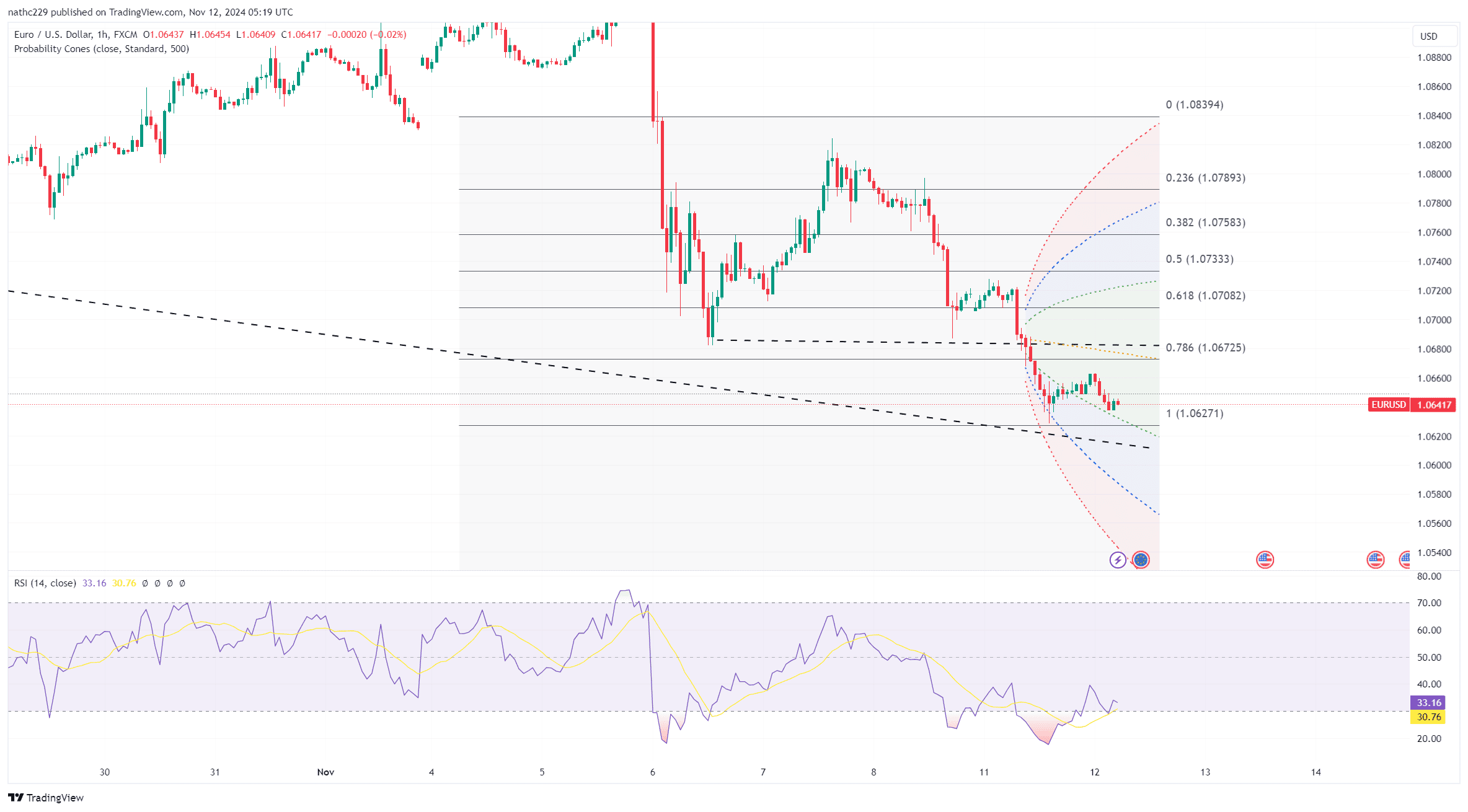

On the technical side, EUR/USD’s break to a 7-month low is significant, with charts showing bearish signals. December Euribor futures imply further rate cuts, with a bull pennant and a large cup-and-handle formation indicating that traders expect the ECB to maintain an aggressive stance compared to the Fed. If these patterns complete, the implied trajectory for EUR/USD could be a move towards parity. The dollar’s yield advantage would be reinforced by a wider Fed-ECB rate spread, strengthening the bearish momentum in EUR/USD. Immediate support is now at April’s low, with resistance near 1.0780, though the downside bias appears strong as long as ECB cuts loom.

Looking ahead, EUR/USD faces considerable headwinds, with ECB expectations heavily weighed down by global trade and economic risks. With key data releases from China and the U.S., and uncertainty surrounding German elections, EUR/USD may struggle to find stability. The path of least resistance appears lower as markets price in a more dovish ECB, keeping parity within reach if bearish conditions persist.