EUR/USD Consolidates Near 1.0900 Ahead of Crucial German Vote; Geopolitical Risks Loom

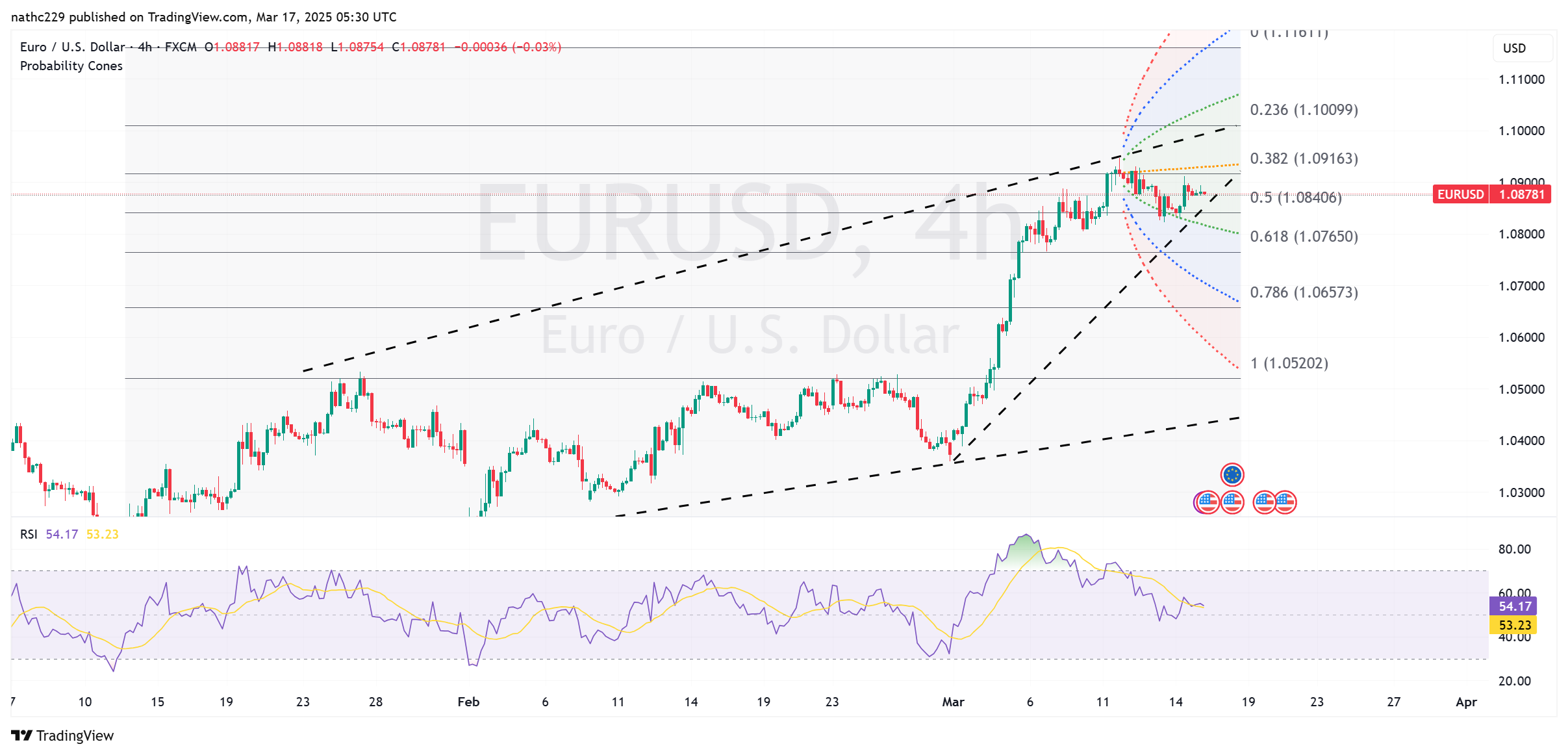

EUR/USD is trading in a tight consolidation range around 1.0890-1.0900, as traders pause ahead of Tuesday's critical German parliamentary vote on a substantial increase in government borrowing. The technical landscape is largely bullish, with the pair holding well above its rising short-term moving averages (5-day at 1.0850, 10-day at 1.0830, and the 21-day at 1.0812), which suggests a solid underlying bullish bias. Additionally, the ascending trajectory of the 21-day Bollinger Bands points to continued volatility, increasing the likelihood of EUR/USD attempting another push higher.

Immediate technical resistance is situated at last week’s peak of 1.0910, which aligns closely with significant option expiry interest at 1.0900 (825 million euros expiring March 17). Above this region, traders will closely watch the December high at 1.0930, where substantial selling interest has capped previous bullish advances. A sustained breakout above 1.0930 could fuel a robust rally toward psychological and technical resistance near 1.1000, potentially attracting fresh speculative longs and activating further bullish momentum. Immediate downside support emerges clearly around the ascending 10-day moving average at approximately 1.0835, followed by critical support at the rising 21-day moving average near 1.0800.

In the near term, EUR/USD price action remains sensitive to geopolitical and fiscal risks. Russia’s insistence on "ironclad" security guarantees in peace negotiations with Ukraine adds uncertainty that could undermine euro strength if tensions escalate further. Meanwhile, the outcome of the German fiscal expansion vote could significantly influence sentiment toward the euro. Approval of increased borrowing would bolster growth expectations and likely encourage EUR/USD bulls, while rejection or delays might trigger a corrective pullback. In either scenario, volatility will likely remain elevated, keeping EUR/USD's trajectory closely tied to headline developments.