EUR/USD bulls struggle as Moody's downgrade impact fades, yield dynamics favor dollar

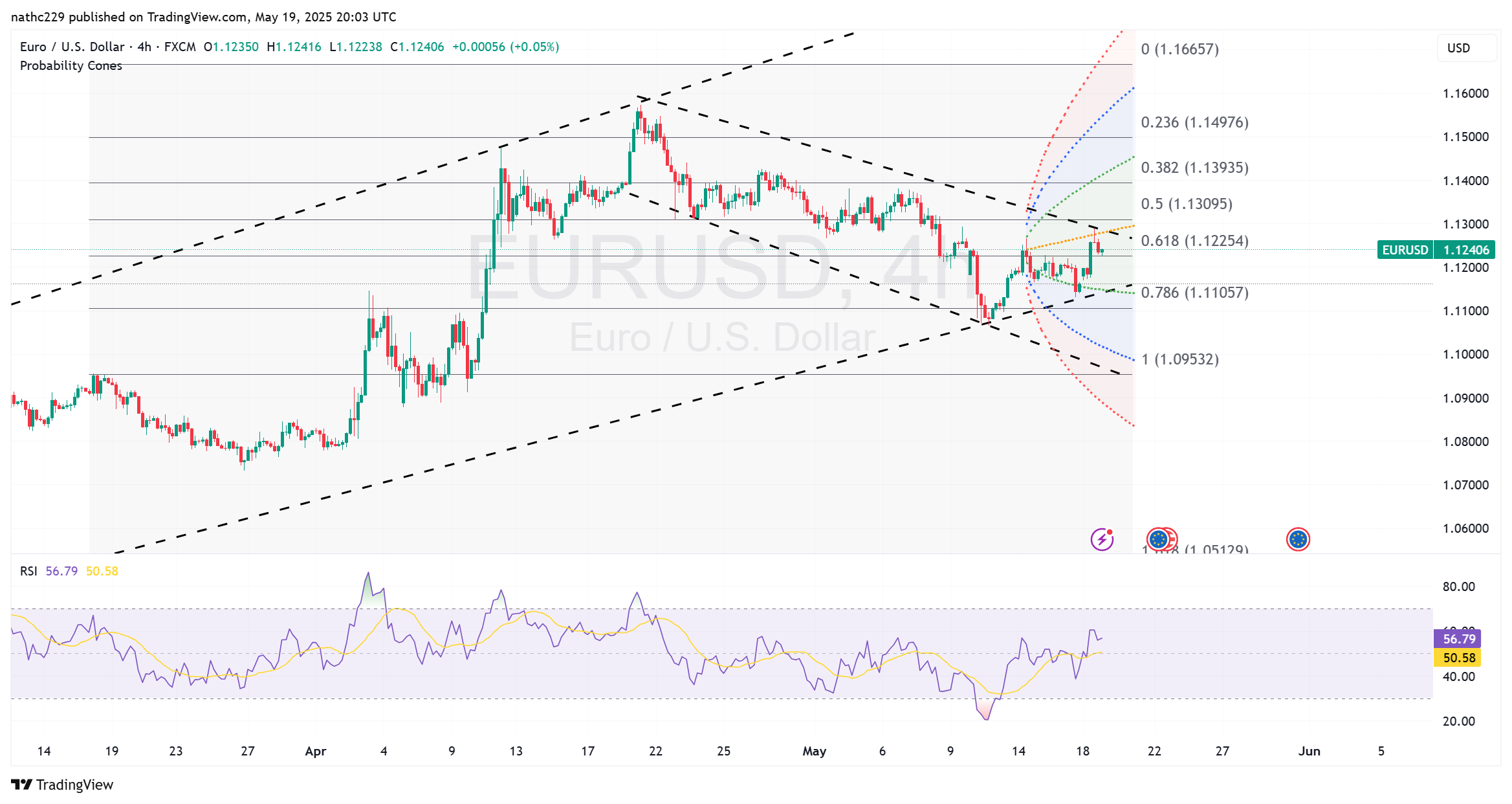

Technical Analysis:

EUR/USD posted strong initial gains early Monday, propelled upwards by Moody’s downgrade of the U.S. credit rating, but rapidly ceded ground as traders reversed their bearish dollar positions. The pair briefly tested the day's high at 1.1288 during the European session before retreating to settle near 1.1225 in New York trading. The shift in sentiment emerged as U.S. assets regained favor, driven by improving Treasury demand, stronger equities, and softer gold prices, signaling that the initial reaction to Moody’s action was already well discounted in market prices.

The technical outlook has become increasingly complex for EUR/USD bulls. Critically, the pair failed to maintain its break above the downward-sloping trendline resistance extending from the April 21 high near 1.1280, highlighting significant selling interest at this level. The subsequent close back below this line raises questions about bulls' near-term conviction. Additionally, the ongoing failure to reclaim the 21-day moving average, currently around 1.1250, coupled with a declining monthly RSI, underscores growing bearish momentum on a medium-term basis. These factors suggest increasing vulnerability unless a clear and sustained break above 1.1280 materializes soon.

Meanwhile, the currency pair still maintains a degree of technical support from shorter-term indicators. Specifically, EUR/USD’s daily RSI remains modestly bullish, reflecting residual buying interest and offering short-term optimism. Crucially, the pair remains supported by the rising daily Ichimoku cloud base around 1.1200, a notable bullish technical reference. Yet fundamentally, yield dynamics strongly favor the dollar: German-U.S. 2-year yield spreads widened to their largest since mid-April, and the terminal rate spread between the Fed and ECB increased marginally in the dollar's favor. These factors likely cap significant EUR/USD upside, suggesting any further rallies could attract renewed selling, placing initial support at Monday’s low at 1.1170 firmly in view, followed by deeper support at the psychological 1.1100 level.