EUR/USD Bulls Hold the Line, But Key Resistance Levels Loom

Detailed Analysis

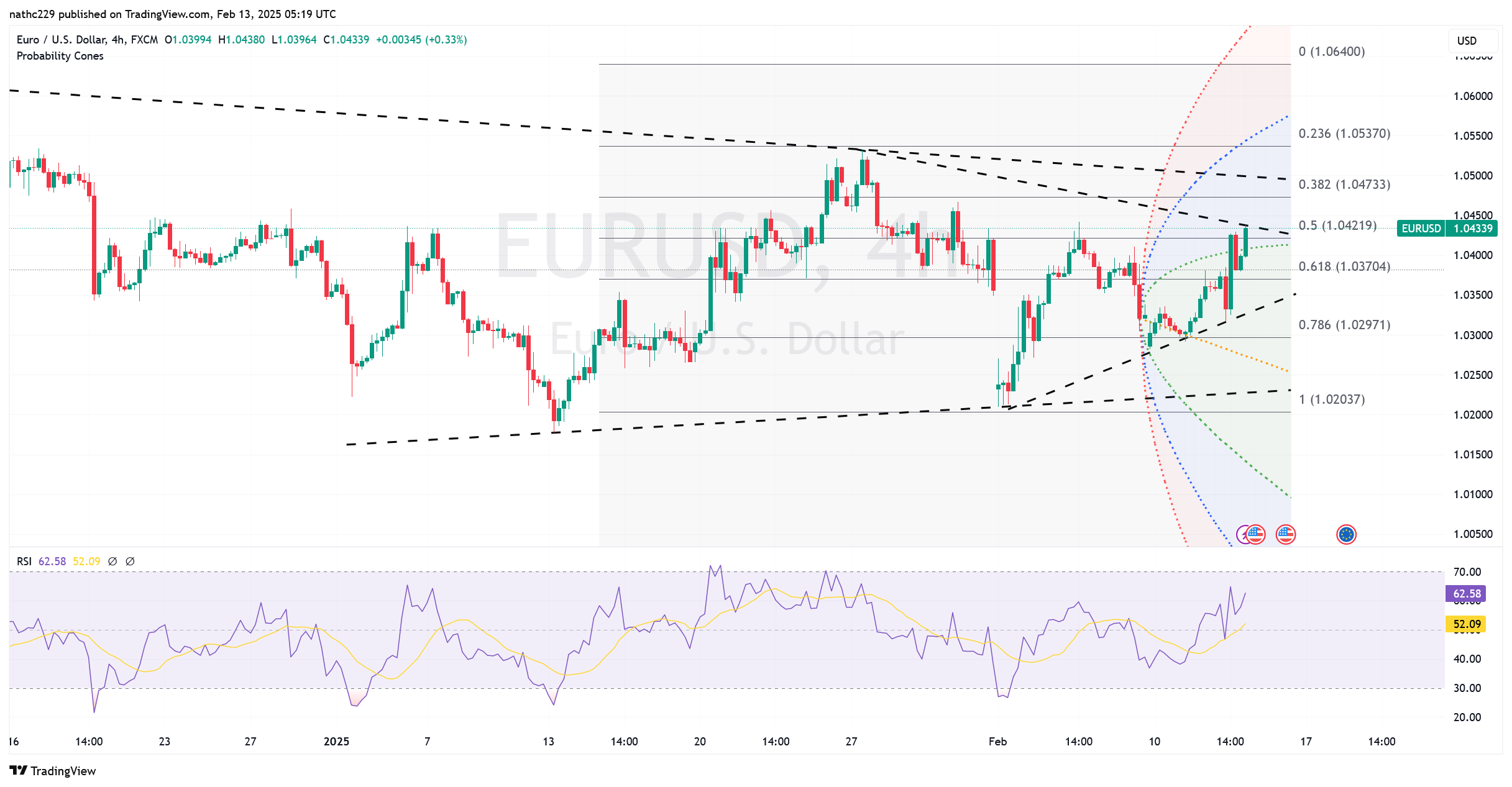

EUR/USD bulls managed to defend key support levels, but upside momentum remains fragile amid hawkish Fed expectations. The pair initially dropped to 1.0317 before rebounding sharply to test resistance near 1.0430, signaling strong demand on dips. Technically, the 21-day and 55-day moving averages have turned supportive, while rising RSI levels hint at continued bullish pressure. Additionally, the presence of a bull hammer pattern on both the daily and monthly charts adds to the optimism for further gains. However, EUR/USD must sustain a break above 1.0430 to confirm a bullish continuation, with the next key resistance at 1.0500-1.0550.

Despite the bullish signals, macroeconomic headwinds persist. The sharp rally in U.S. inflation breakevens, particularly the 2-year break-even rising above 3.2%, suggests that inflation expectations remain well above the Fed’s 2% target. This has pushed U.S. yields higher, limiting EUR/USD's upside potential. If the pair fails to hold above 1.0415-1.0430, selling pressure could intensify, driving a retest of 1.0350, with 1.0317 as a key support zone. The daily Ichimoku cloud base is also providing resistance, and a break below could expose EUR/USD to further downside risks.

Market participants are closely watching upcoming U.S. data, particularly weekly jobless claims and PPI, which could influence Fed expectations and dictate EUR/USD's next move. Any upside surprises in inflation data could reignite dollar strength, pushing EUR/USD towards parity. On the flip side, weaker prints could help the euro hold its gains. Additionally, external factors like Powell’s fiscal policy stance and geopolitical developments will continue to shape risk sentiment, adding further uncertainty to the pair’s trajectory.