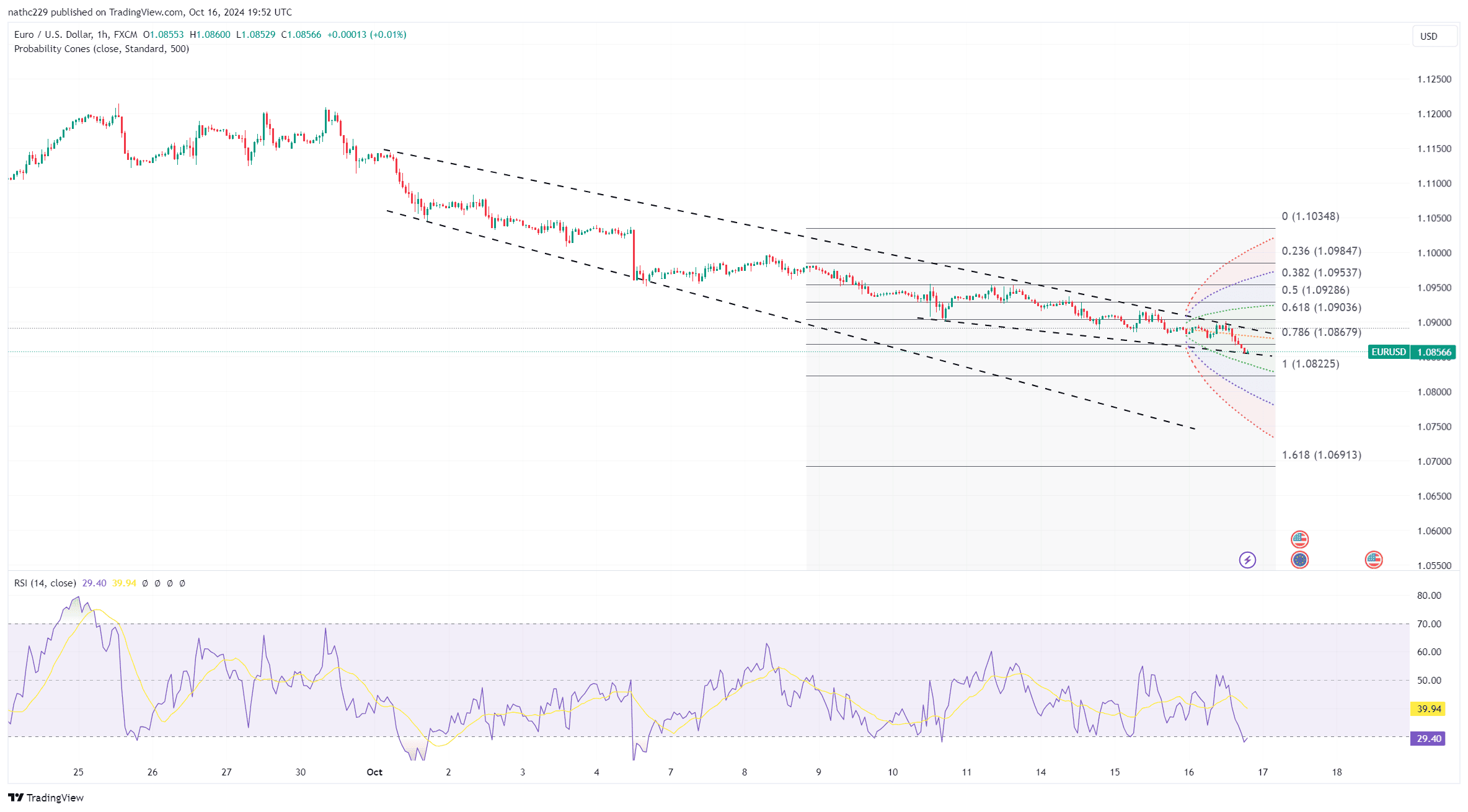

EUR/USD Breaks Key Support as Bearish Technicals Reinforce Downtrend

EUR/USD has dropped sharply, hitting a fresh two-month low of 1.0871 as traders continue to pare back long positions. After rallying to 1.1214, the pair has faced relentless selling pressure, particularly after the European Central Bank’s (ECB) meeting, as traders adjust their expectations for euro strength. Rising U.S. Treasury yields have strengthened the dollar, pushing EUR/USD below its 200-day moving average at 1.0874, a critical support level. The break below this level adds to the growing list of bearish technical signals and could embolden bears to target lower levels in the coming sessions. The pair’s failure to sustain any meaningful rallies suggests that downside risks are increasing.

Technically, EUR/USD’s outlook has deteriorated significantly. The pair is trading below its 5-DMA and the daily Ichimoku cloud, with falling RSI readings pointing to further downside potential. The breach of the 200-DMA reinforces the bearish structure, and if the pair closes below this level, traders are likely to set their sights on the 1.0775-1.0800 support zone. This area could provide a temporary base for EUR/USD, but the overall trend remains bearish. If the pair fails to find support at these levels, it could open the door to a further slide toward 1.0700. The bearish sentiment is further fueled by strong U.S. economic data and expectations of a rate cut at the Federal Reserve’s November meeting.

Looking ahead, the focus will shift to U.S. data and the upcoming Fed meeting, where a rate cut could provide some relief for EUR/USD. However, in the near term, the technical picture suggests further downside risks. The 1.0775-1.0800 support zone is likely to be the next target for bears, and a break below this area could accelerate the decline. On the upside, any recovery attempts are likely to face strong resistance near the 200-DMA at 1.0874, with the 5-DMA also acting as a cap on any rallies. For now, the path of least resistance remains to the downside as traders adjust to the evolving macroeconomic landscape.