EUR/USD Bears Eye Deeper Slide Amid Strong U.S. Yields and Bearish Technical Signals

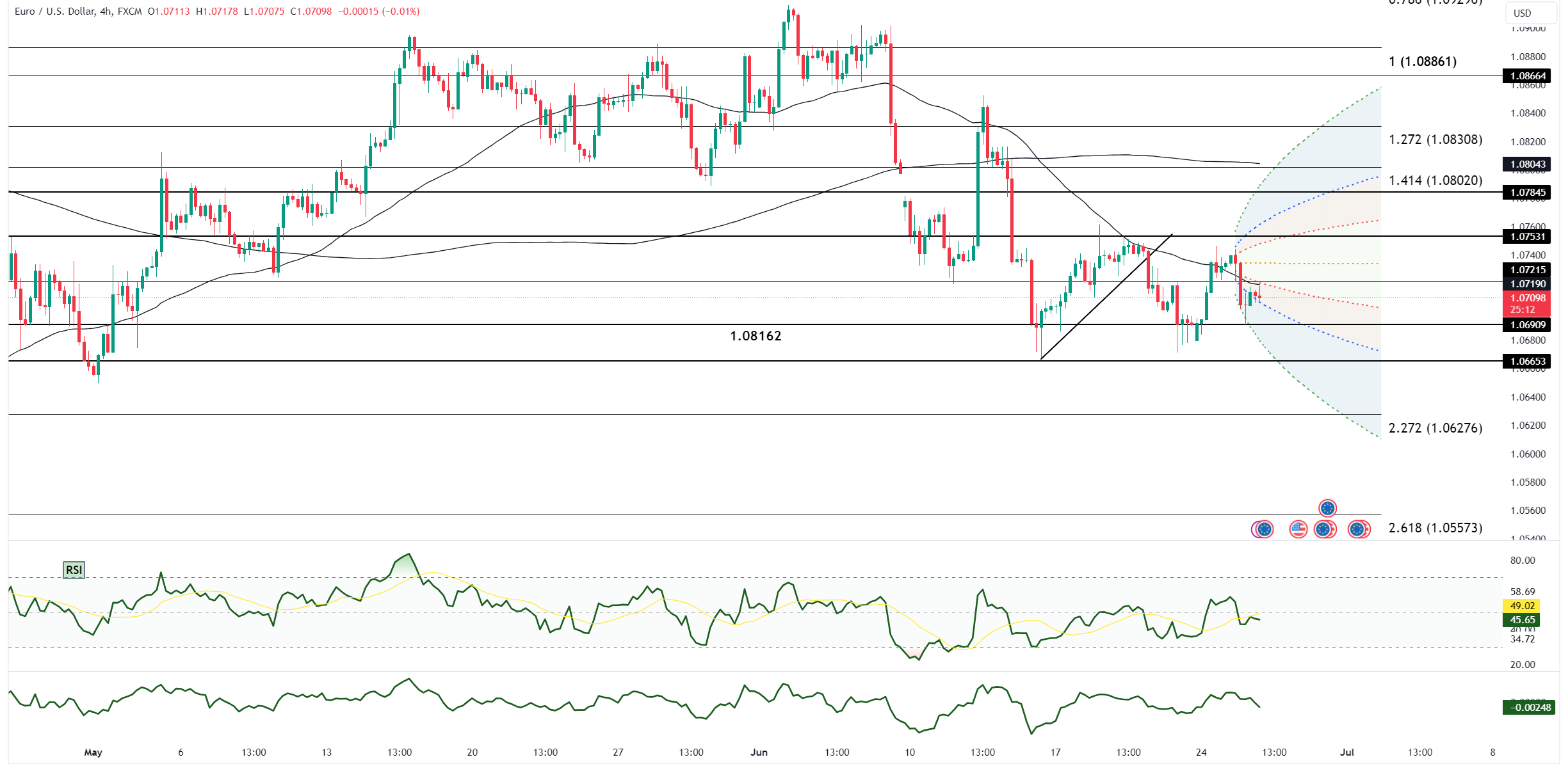

EUR/USD bulls face a challenging environment as supportive data is crucial to counteract bearish technical signals. On Tuesday, EUR/USD erased earlier gains, falling below the 10-day moving average (10-DMA), and there is potential for a deeper slide unless upcoming U.S. data shifts momentum. Federal Reserve Governor Michelle Bowman stated she does not anticipate rate cuts in 2024 and is open to further rate hikes if needed. Investors are closely watching the weekly jobless claims and May Personal Consumption Expenditures (PCE) reports; lower jobless claims and higher PCE could boost U.S. yields and the dollar, widening its yield advantage over the euro. This scenario could reinforce bearish technical signals and push EUR/USD lower, potentially to the 1.0550/1.0600 area, completing the pattern from the June 4 to June 14 drop. The pair is currently below multiple daily moving averages and the daily cloud, with falling monthly and daily Relative Strength Indexes (RSIs), strengthening the bearish outlook. Additionally, investor uncertainty surrounding the upcoming French elections adds to EUR/USD downside risks. Bulls need significantly weak U.S. data to drive any rally for EUR/USD.

In the New York session, EUR/USD opened near 1.0726 after reaching 1.0742 overnight, with the decline continuing. Strong U.S. yields have driven demand for the dollar, pushing USD/CNH above 7.2907. A drop in commodity prices and some equity gains eroding helped support the U.S. dollar. EUR/USD fell below the 10-day moving average, hitting 1.06904 before a slight rebound. The pair lifted above 1.0704 late in the session, down by 0.21% in the New York afternoon. Technical indicators are bearish, with falling RSIs and the pair consolidating its decline from the June 4 high. Key risks in Europe include the German July GfK and French June consumer confidence data. In the U.S., May new home sales data poses a risk for the New York session on Wednesday.

Open an account today to unlock the benefits of trading with CMS Financial