EUR/USD Bears Eye 200-DMA Support Amid Fed Uncertainty

Technical Analysis:

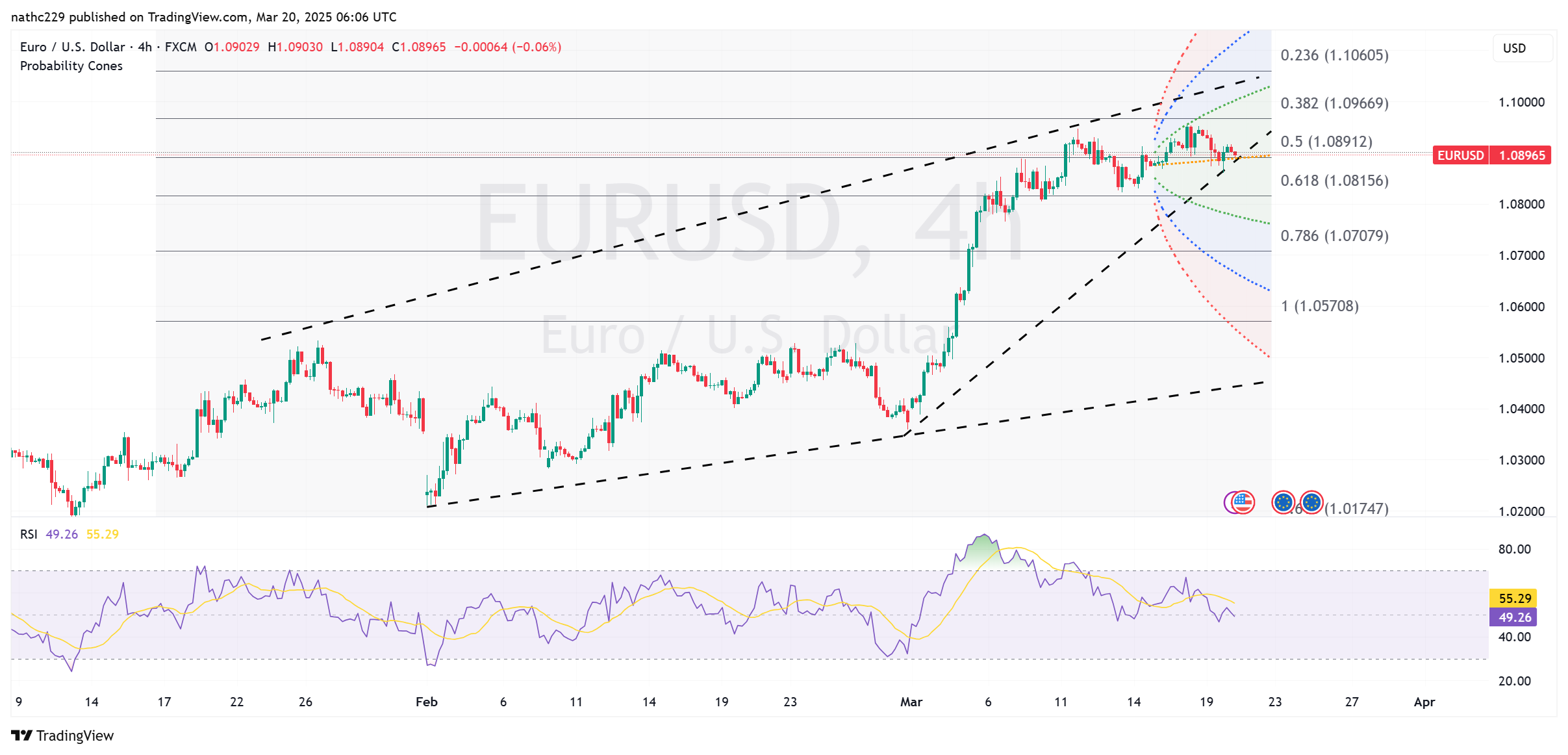

EUR/USD reversed sharply on Wednesday after failing to break decisively through major resistance near the 76.4% Fibonacci retracement level of the previous downturn from 1.1214 to 1.0125, situated around 1.0950. After briefly marking a session high at 1.0945 overnight, the pair faced aggressive selling pressure that drove prices down toward a session low of 1.0860 in the New York trading session, underscoring heightened caution among bulls ahead of the Federal Reserve’s policy update.

The technical rejection at this critical Fibonacci resistance signals renewed bearish sentiment, particularly if the Fed’s projections do not align with market expectations for substantial easing in 2025. A Fed stance reflecting fewer rate cuts than the priced-in 75 basis points could trigger a strong USD rally driven by rising U.S. yields, widening German-U.S. rate differentials, and renewed dollar strength. In such a scenario, EUR/USD would likely break below immediate support at 1.0850, potentially accelerating downside momentum toward the psychologically and technically important 200-day moving average near 1.0750. A sustained break beneath this moving average would significantly damage bullish confidence and put key long-term support around 1.0550-1.0600 firmly in play.

On the upside, bulls must reclaim and hold above initial resistance at 1.0910—the recent consolidation midpoint—before attempting a renewed assault on stronger resistance at 1.0950. Momentum indicators are showing signs of waning bullish strength, with the daily RSI now flattening and the MACD histogram narrowing. Without a decisive close above 1.0950, the technical bias remains tilted downward, favoring bearish continuation unless fundamental cues from the Fed explicitly favor easing narratives.