USD/JPY Builds Momentum Off Recent Lows; Near-Term Bias Favors Further Gains

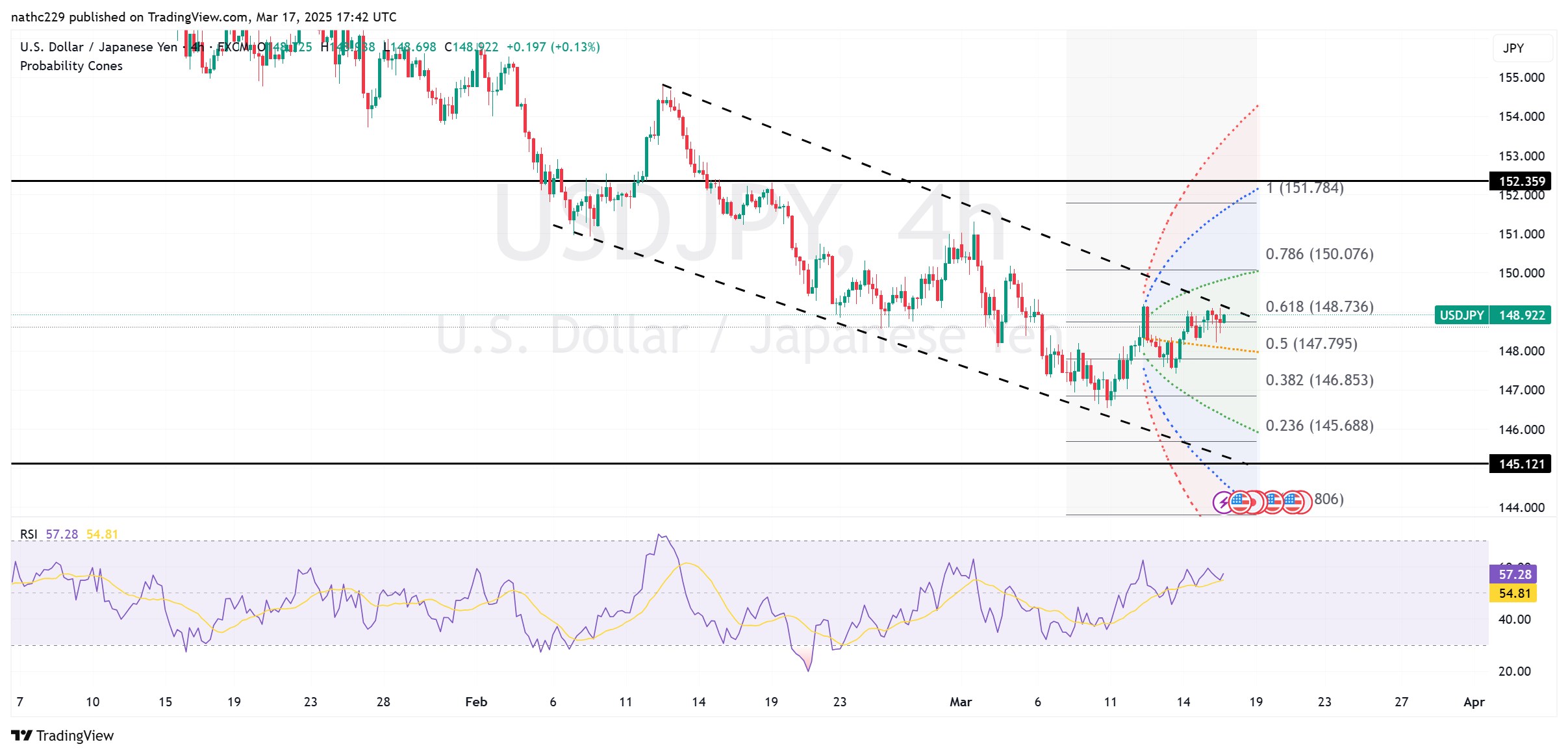

USD/JPY extended its recovery Monday, climbing from an intraday low at 148.48 to a high of 149.10, reinforcing last week's rebound from the five-month trough at 146.55. The price action clearly signals a corrective rebound after substantial yen-driven strength last week. Technically, the pair's successful hold above the lower 21-day Bollinger band (146.94) on the daily chart provided crucial support, enabling the recovery. Additionally, bullish short-term momentum indicators, such as an upward-trending RSI crossing above neutral (50), suggest potential for continued upward corrections in the near term.

Currently, USD/JPY confronts immediate overhead resistance at Monday's high near 149.10. Above this level, significant resistance lies at 149.53, marking the February 25 low and representing a key inflection point on the short-term charts. A sustained move above this resistance could target higher levels, specifically the critical psychological resistance at 150.00, near the 21-day moving average currently around 149.68. Should the pair clear this zone decisively, broader bearish pressure could ease significantly, allowing for an extended run toward recent congestion highs near 151.10.

Despite current bullish momentum, downside risks persist due to ongoing geopolitical and economic uncertainty. Traders will closely monitor Japan’s upcoming economic releases and the Bank of Japan’s rate decision, with any surprises potentially reactivating yen demand. If USD/JPY struggles to breach resistance around 149.53-150.00 convincingly, the bearish scenario could quickly resume, targeting initial support around 147.20, followed by the key October 2 high at 146.52. For now, the short-term technical bias remains tilted bullish, contingent on sustained trade above immediate support at the 9-day EMA near 148.38.