Mastering Market Movements: A Comprehensive Trading Strategy for Bull and Bear Markets

Understanding Key Trading Indicators

1. Average True Range (ATR)

The ATR quantifies market volatility by averaging the range between high and low prices over a set period. This indicator helps traders gauge the degree of price movement and volatility in the market.

2. Average Directional Index (ADX)

The ADX measures the strength of a trend without indicating its direction. A high ADX value signifies a robust trend, while a low ADX value points to a weak trend or a ranging market.

3. Rate of Change (ROC)

The ROC calculates the percentage change in price between the current price and that of a previous period. This momentum oscillator helps traders assess the speed and magnitude of price movements.

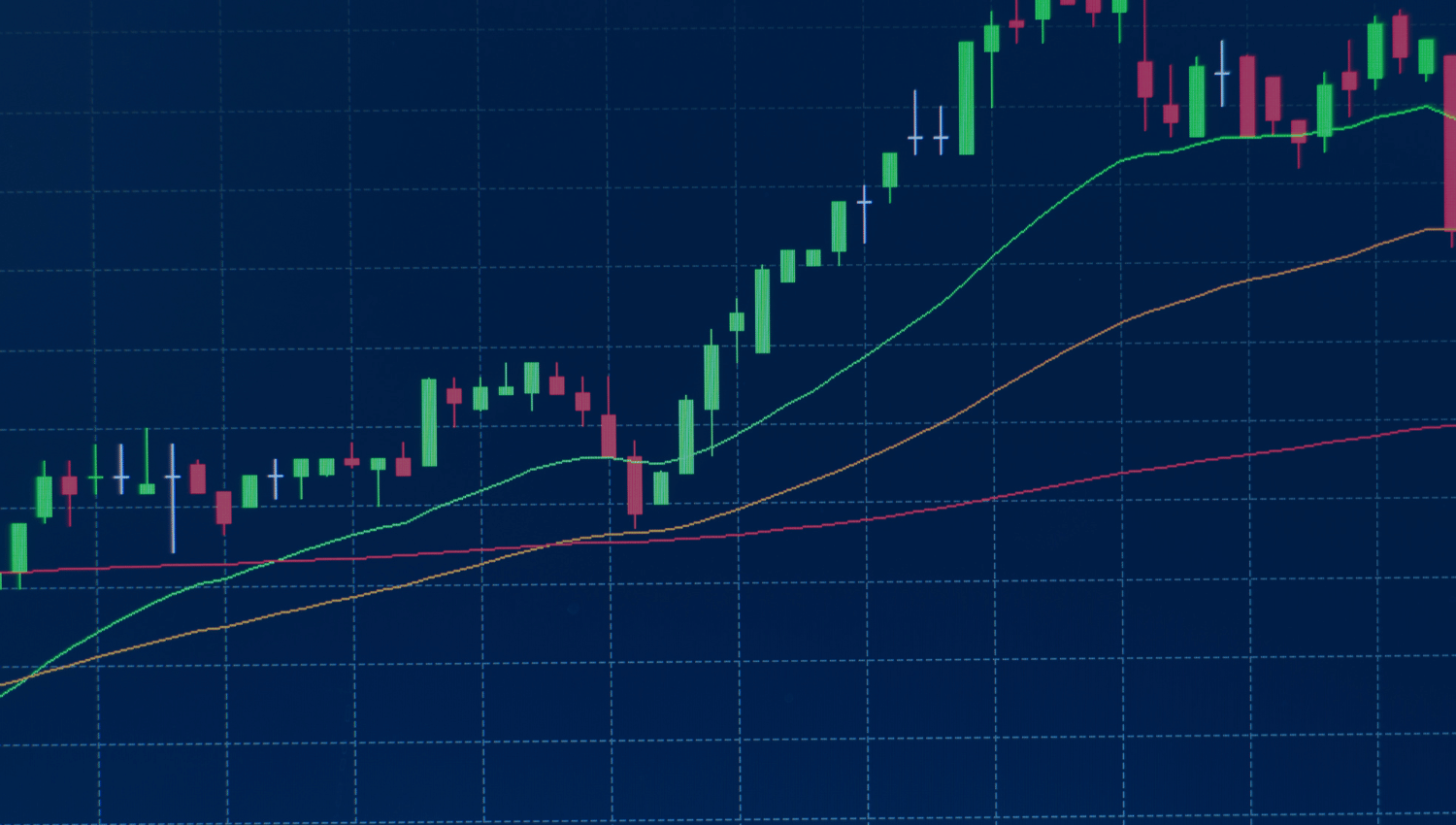

Crafting a Robust Trading Strategy

Combining ATR, ADX, and ROC can form a comprehensive trading strategy for both bullish and bearish markets. Here’s how:

Identifying Trend Strength with ADX

Utilise ADX to determine if the market is trending or ranging. Typically, an ADX value above 25 indicates a strong trend, while below 25 suggests a weak or ranging market.

Gauging Market Volatility with ATR

Use ATR to assess market volatility. High ATR values indicate increased volatility, influencing the placement of stop-loss and take-profit orders.

Assessing Momentum with ROC

ROC measures the speed of price changes. Positive ROC values signify bullish momentum, while negative values indicate bearish momentum.

Bull Market Strategy

Identifying Bull Market Conditions:

- ADX > 25: Indicates a strong trend.

- +DI > -DI: Positive directional movement.

- ROC > 0: Positive price momentum.

Entry Criteria:

- Wait for a price pullback.

- Enter a long position when the price bounces off support or a moving average.

- Set stop loss using ATR (e.g., 2-3 times ATR below the entry price).

Position Sizing:

- Determine position size using ATR (e.g., risk 1% of account per trade with a stop loss at 2 times ATR).

Exit Strategy:

- Trail stop loss using ATR (e.g., 3 times ATR below the current price).

- Consider taking partial profits when ROC reaches overbought levels (e.g., ROC > 10).

- Exit if ADX drops below 20 or -DI crosses above +DI.

Bear Market Strategy

Identifying Bear Market Conditions:

- ADX > 25: Indicates a strong trend.

- -DI > +DI: Negative directional movement.

- ROC < 0: Negative price momentum.

Entry Criteria:

- Wait for a price rally.

- Enter a short position when the price bounces off resistance or a moving average.

- Set stop loss using ATR (e.g., 2-3 times ATR above the entry price).

Position Sizing:

- Determine position size using ATR (e.g., risk 1% of account per trade with a stop loss at 2 times ATR).

Exit Strategy:

- Trail stop loss using ATR (e.g., 3 times ATR above the current price).

- Consider taking partial profits when ROC reaches oversold levels (e.g., ROC < -10).

- Exit if ADX drops below 20 or +DI crosses above -DI.

Additional Considerations

Trend Confirmation:

- Use longer-term moving averages (e.g., 50-day and 200-day) to confirm the overall market trend.

Volatility Adjustment:

- Adjust position sizes based on ATR, taking smaller positions in high volatility environments.

- Consider widening stop losses during high volatility periods.

Momentum Confirmation:

- Use ROC to confirm the trend's strength, with higher absolute ROC values indicating stronger momentum.

Risk Management:

- Always use stop losses to protect capital.

- Consider options strategies to limit downside risk in volatile markets.

Market Context:

- Stay aware of important economic events and news that might impact market direction.

- Reduce position sizes or stay out of the market during major announcements.

Backtesting and Optimization:

- Backtest the strategy on historical data to optimise parameters for specific markets or timeframes.

- Regularly review and adjust the strategy based on market conditions.

Remember, no trading strategy is foolproof, and past performance does not guarantee future results. Always manage risk carefully and consider seeking professional financial advice before implementing any trading strategy.

Open an account today to unlock the benefits of trading with CMS Financial