Yen Rally Impacts Investments, Pressures Global Currencies Ahead of BOJ Policy Shift

The yen's recent rise has significant implications for other currencies as many investors have sold the yen to fund their investments in carry trades. This rally increases the risk of FX losses for trades that rely on stable markets to profit from interest rate differentials. The Japanese currency, weakened by the world's lowest interest rate, is the optimal funding source for these trades. The Bank of Japan's continuous bond purchases have driven the yen to record lows this year. However, this trend is expected to change on July 31, when the Bank of Japan is anticipated to announce changes in its bond-buying programme. Although bond purchases are likely to continue, potentially driving the yen down in the long term, there is a strong chance that a market heavily short on yen could react significantly in the near term. Adjusting this potentially overcrowded trade could lift the yen much further, putting pressure on currencies that investors have purchased.

Many carry trades focus on the dollar but also favour the pound, euro, Canadian and New Zealand dollars, as well as less liquid currencies like Mexico's peso, Hungary's forint, and Poland's zloty. A shakeout of carry trades could lead to the unwinding of popular speculative bets, such as those on the pound and New Zealand dollar rising. Pressure on the Swiss franc could also increase if traders switch their funding source for carry trades to another major currency with a suitably low interest rate.

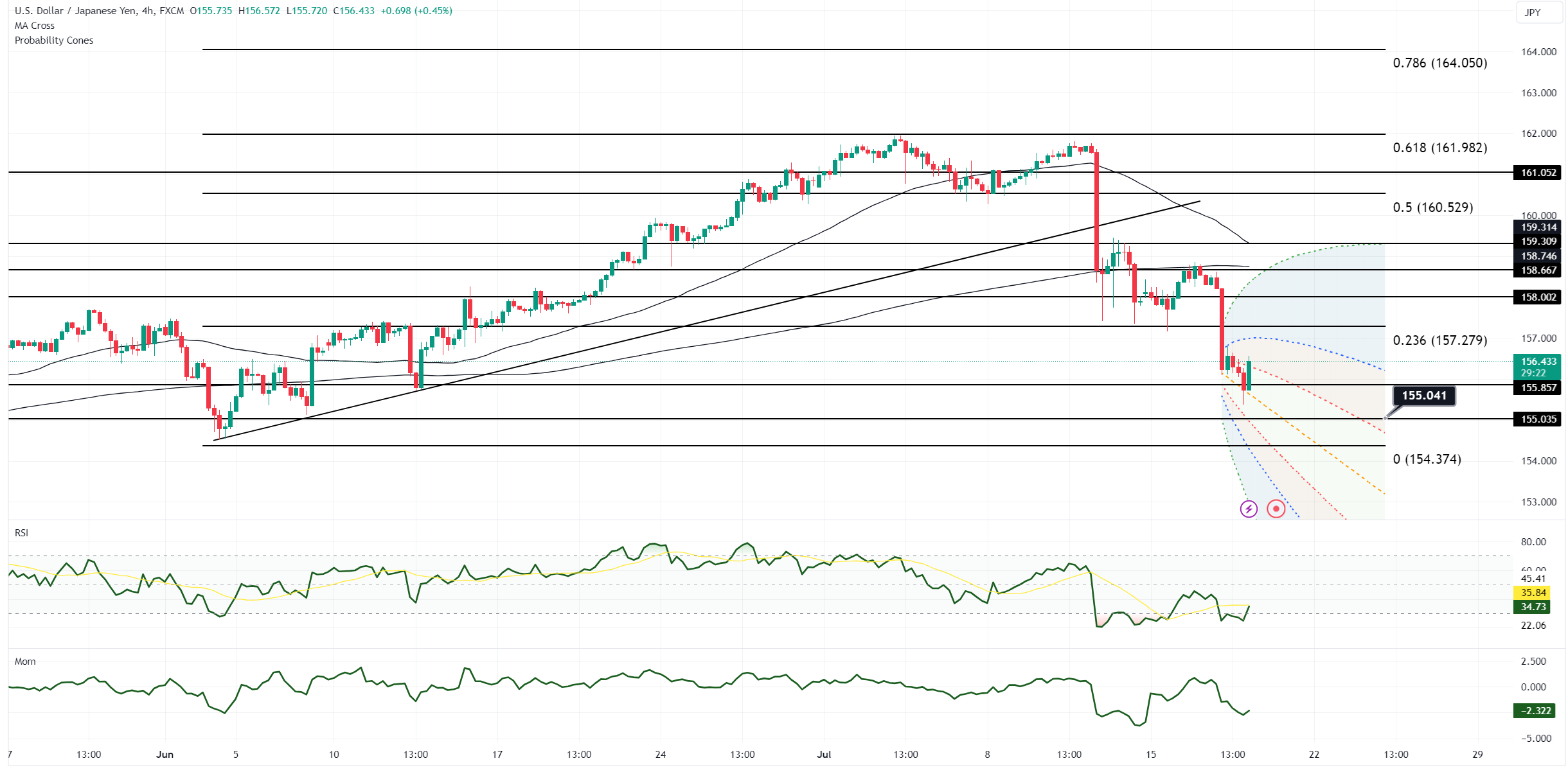

The yen's rally, which has soured the risk tone and softened bond yields, adds fuel to the bid for the Japanese currency. USD/JPY is now trading below the 55-day moving average (DMA), opening the door to the 155-155.10 range, which aligns with the 100-DMA. The sizeable move in the yen has raised speculation about further intervention. However, EBS volumes suggest this is not the case, with upcoming BOJ data expected to shed more light on the situation. Meanwhile, Federal Reserve officials have hinted at a rate cut in September.

With these dynamics at play, the market is closely watching how the yen's rise will impact global currencies and carry trades, especially as the Bank of Japan's policy changes loom on the horizon.

Open an account today to unlock the benefits of trading with CMS Financial