USD/JPY Rebounds Amidst Intervention Concerns, Eyes on U.S. Data for Direction

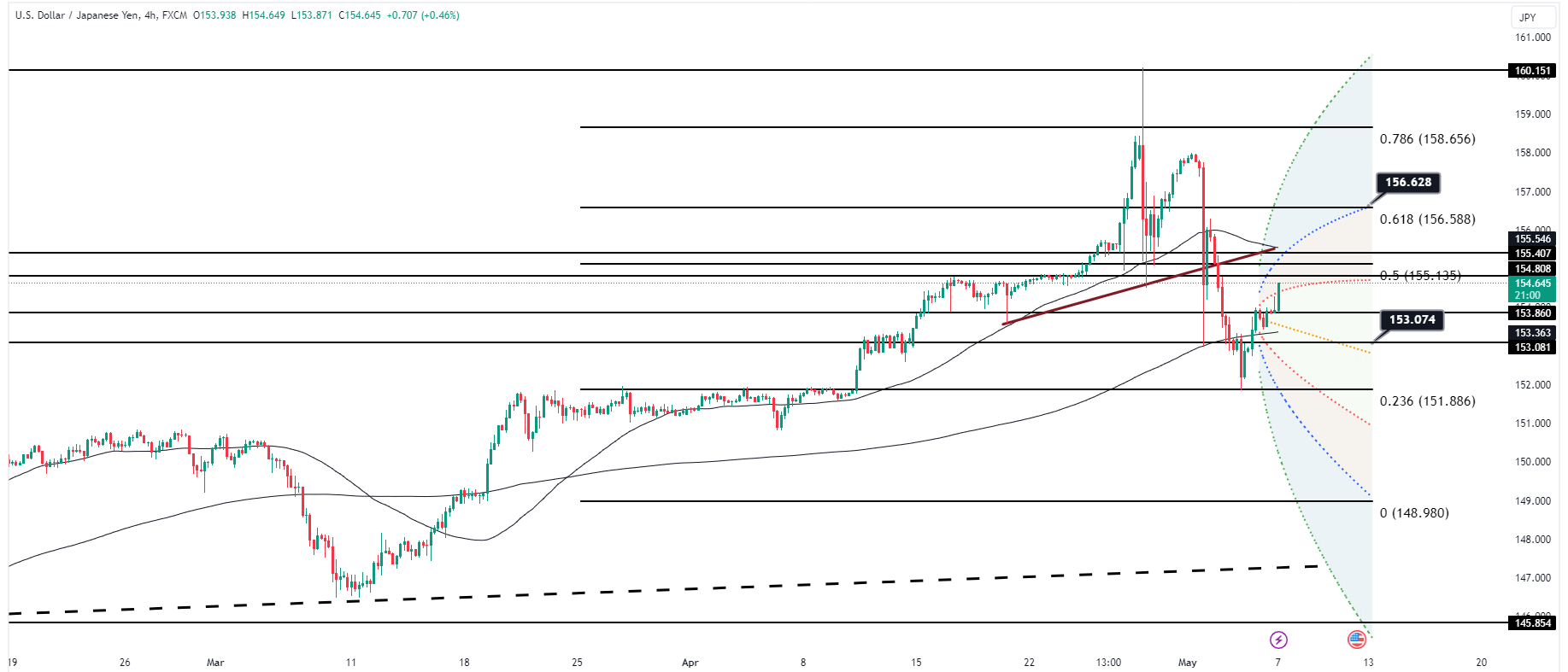

The USD/JPY pair experienced a significant 0.6% increase on Monday, albeit with potential limitations on further upside movement expected before the release of key U.S. economic data on May 15th, including the Consumer Price Index (CPI) and sales report. This rise follows a period of rebound from a sharp plunge observed last week, attributed to suspected Japanese interventions, coupled with a recovery from dovish U.S. employment and ISM services reports released on Friday. The resurgence in USD/JPY rates has provided carry traders and Japanese importers with an opportunity to revisit the breakout trade initiated in April, despite concerns over intervention risks and a decline in Treasury-JGB yields spreads. Looking ahead, with the impending CPI and retail sales reports, a potential reversion towards daily kijun and tenkan levels at 155.53/6.05, as well as Fibos at 155.06/6.05, could occur, contingent upon the data signaling a cooling from the previous hot March readings, which might influence the Fed's stance on rate cuts.

The recent rebound in USD/JPY rates, following a notable decline attributed to suspected Japanese interventions and dovish U.S. economic reports, underscores the currency pair's sensitivity to both domestic and international factors. With the upcoming release of key U.S. economic indicators, including the CPI and retail sales reports, market participants are closely monitoring the potential impact on future monetary policy decisions by the Federal Reserve.

The trajectory of USD/JPY hinges on several factors, including the sustainability of U.S. yield levels and any signs of inflationary pressures. A mean reversion towards daily kijun and tenkan levels, as well as Fibos, suggests a possible correction in the near term. However, the extent of any pullback could be influenced by intervention risks and the Fed's response to economic data.