USD/JPY Holds Steady Above 200-DMA as Markets Brace for U.S. Election and Fed Rate Decision

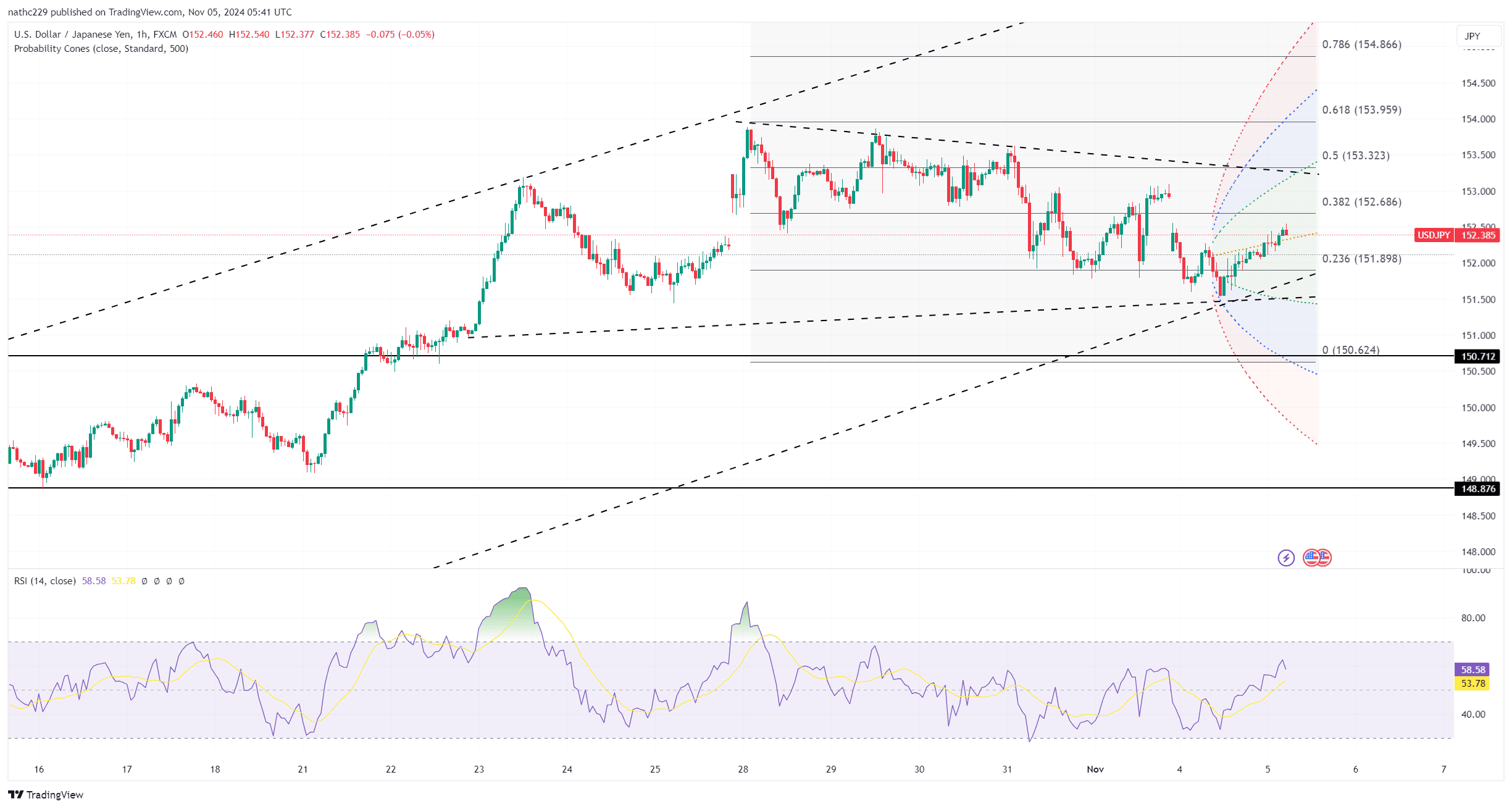

USD/JPY found stability above its 200-day moving average at 151.57, despite an early drop following a decline in U.S. Treasury yields. The pair traded within a tight range of 151.54-152.95 as anticipation builds around Tuesday's U.S. election and the Federal Reserve's rate decision later in the week. One-week implied volatility has surged to over 18.0%, the highest level since early October, indicating that markets are preparing for potentially significant price movements. Key resistance levels include last week’s double-top at 153.87-88, followed by the 154 psychological threshold.

From a technical standpoint, USD/JPY’s position above the 200-DMA reinforces the pair’s bullish tone, with a close above 153.87 needed to signal further upside potential. Support below the 200-DMA includes the October 23 low at 151.04, October 21 high at 150.88, and the 100-day moving average at 150.37. Should USD/JPY break below these support levels, it may indicate a reversal in sentiment, potentially triggering a more pronounced correction toward 150.00. However, as long as the pair stays above 151.57, bulls maintain control.

This week’s U.S. election and FOMC decision could be pivotal for USD/JPY’s direction. A decisive outcome in the election or signals of caution from the Fed regarding further rate cuts could push USD/JPY higher, particularly if market sentiment shifts toward dollar strength. Conversely, a less favorable election result or dovish Fed outlook could drive demand for the yen, putting USD/JPY under pressure. With volatility elevated, traders should prepare for rapid moves, particularly if key support or resistance levels are tested in response to major event outcomes.