USD/JPY Climbs as Treasury Yields and Policy Accommodation Drive Rally

USD/JPY surged on Wednesday, rising sharply after a stronger-than-expected ADP employment report boosted U.S. Treasury yields and fueled dollar demand. The solid labor market data reinforced expectations that the U.S. economy remains strong, driving up bond yields and supporting the greenback. In parallel, Prime Minister Ishiba’s reiteration of his desire for ongoing monetary accommodation, following discussions with Bank of Japan Governor Ueda, pressured the yen. This dovish stance provided further fuel for the dollar’s rally against the yen.

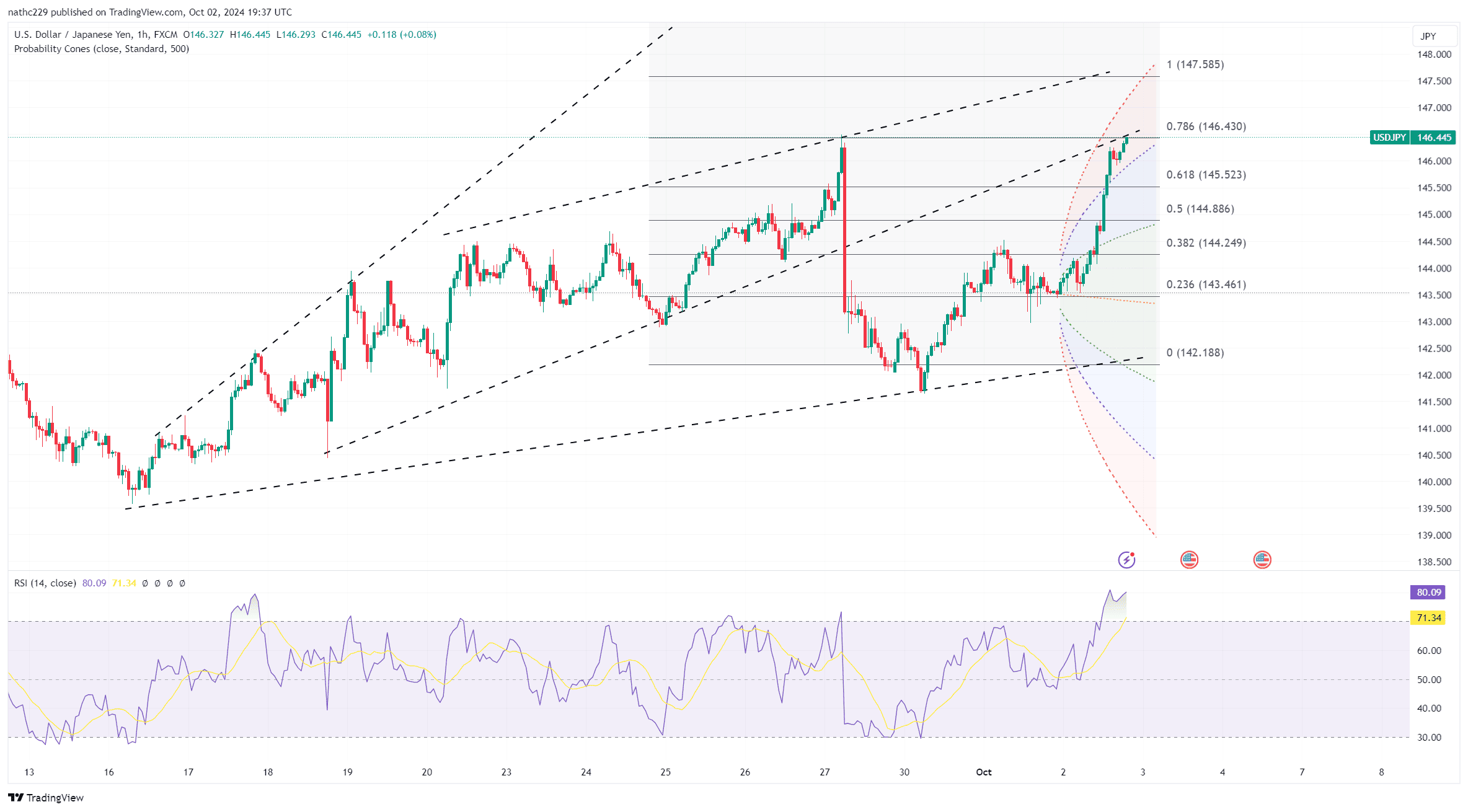

From a technical perspective, USD/JPY is nearing a critical resistance level around 146, with the pair threatening to close above the top of a narrow Bollinger range. If the pair breaks this level, further gains could target the Sept. 27 high of 146.495, set on the day of the LDP leadership elections. In addition to favorable yield differentials, shifts in gamma above 145 option expiries and fix-related buying at the start of the new quarter added to the bullish momentum. U.S. futures markets turned more bullish on the yen around this level back in mid-August, suggesting this zone is of heightened significance for traders.

Looking forward, the outlook for USD/JPY remains tilted to the upside, with the pair likely to benefit from rising U.S. yields and Japan’s commitment to accommodative monetary policy. Traders will be closely watching U.S. economic data, as well as any further commentary from the Bank of Japan or government officials, for clues about the future trajectory of USD/JPY. A breakout above 146.495 could open the door for a more sustained rally, while a failure to break through could lead to a temporary consolidation or pullback.