USD/JPY Bulls Stumble as Japanese Policy and Economic Factors Favor the Yen"

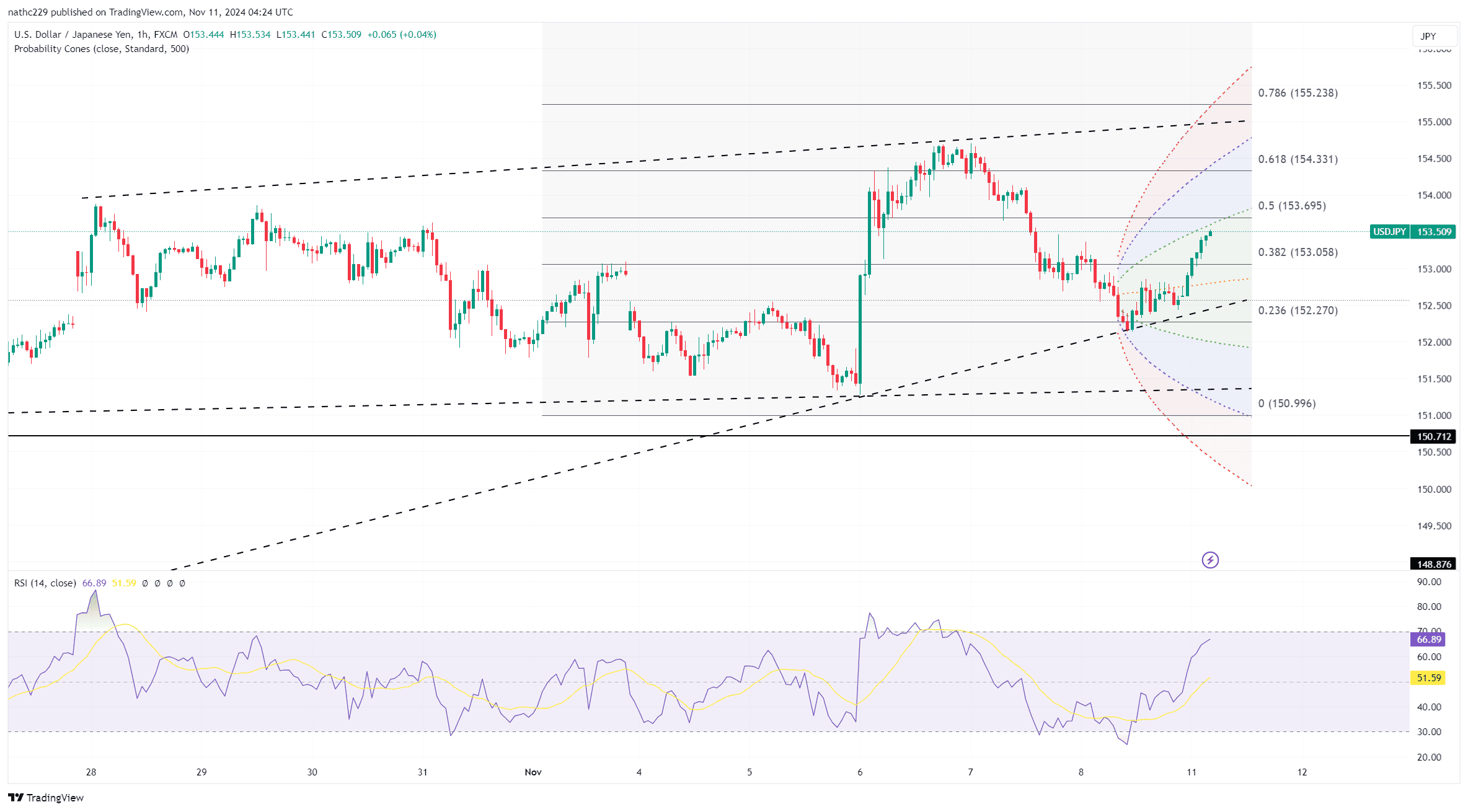

USD/JPY’s recent failure to break above the 155 pivot level has emboldened yen bulls, especially as political developments in Japan and potential policy rate convergence between the U.S. and Japan create a favorable backdrop for the yen. Currently trading above its 200-day moving average at 151.69, USD/JPY remains in a precarious position, with bears eyeing further downside if the pair cannot sustain this support. A wave of Japanese repatriation flows, including $29.2 billion in foreign bond sales and $7.7 billion in equity sales, has added a fresh tailwind to the yen. Speculation around Japanese authorities intervening to stabilize the yen also continues to bolster yen sentiment.

Technically, USD/JPY’s inability to hold gains above 155 points to underlying weakness. A close below the 200-day moving average could trigger further selling pressure, targeting support around 150, with a break below this level potentially signaling a broader trend reversal. The potential for U.S.-Japanese policy rate convergence has become a prominent factor in yen strength. The market currently expects a Fed funds rate under 4% and a possible BOJ policy rate of 0.50% by mid-2024, which could further erode the dollar’s rate advantage and weigh on USD/JPY.

The upcoming U.S. CPI report could provide additional directional cues for USD/JPY, as a soft inflation print would likely reinforce Fed easing expectations. Meanwhile, Japan’s political situation adds another layer of complexity. As Parliament convenes to choose a new prime minister, the incoming government’s stance on BOJ policy could be pivotal. Yuichiro Tamaki’s recent call for the BOJ to delay rate hikes until wage growth consistently exceeds inflation signals that yen bulls may receive additional support if the political environment leans toward cautious monetary policy adjustments, further pressuring USD/JPY downward.