USD/JPY Bearish Bias Strengthens as Ishiba's Win and Economic Data Weigh on Sentiment

USD/JPY has dropped sharply from 142.95 to 141.65, reflecting growing concerns over Japan’s economic outlook and political uncertainty following the victory of Ishiba in the LDP leadership race. The yen gained strength as Ishiba, known for his critical stance on Japan’s prolonged easy monetary policy, won the race to become the country’s next Prime Minister. The market reacted strongly to his win, with Japan’s Nikkei diving and JGB yields spiking as investors priced in the potential for reduced monetary stimulus. In tandem with these developments, Japan's latest data showing a decline in factory output has cast further doubt on the strength of the economic recovery, contributing to the bearish tone for USD/JPY.

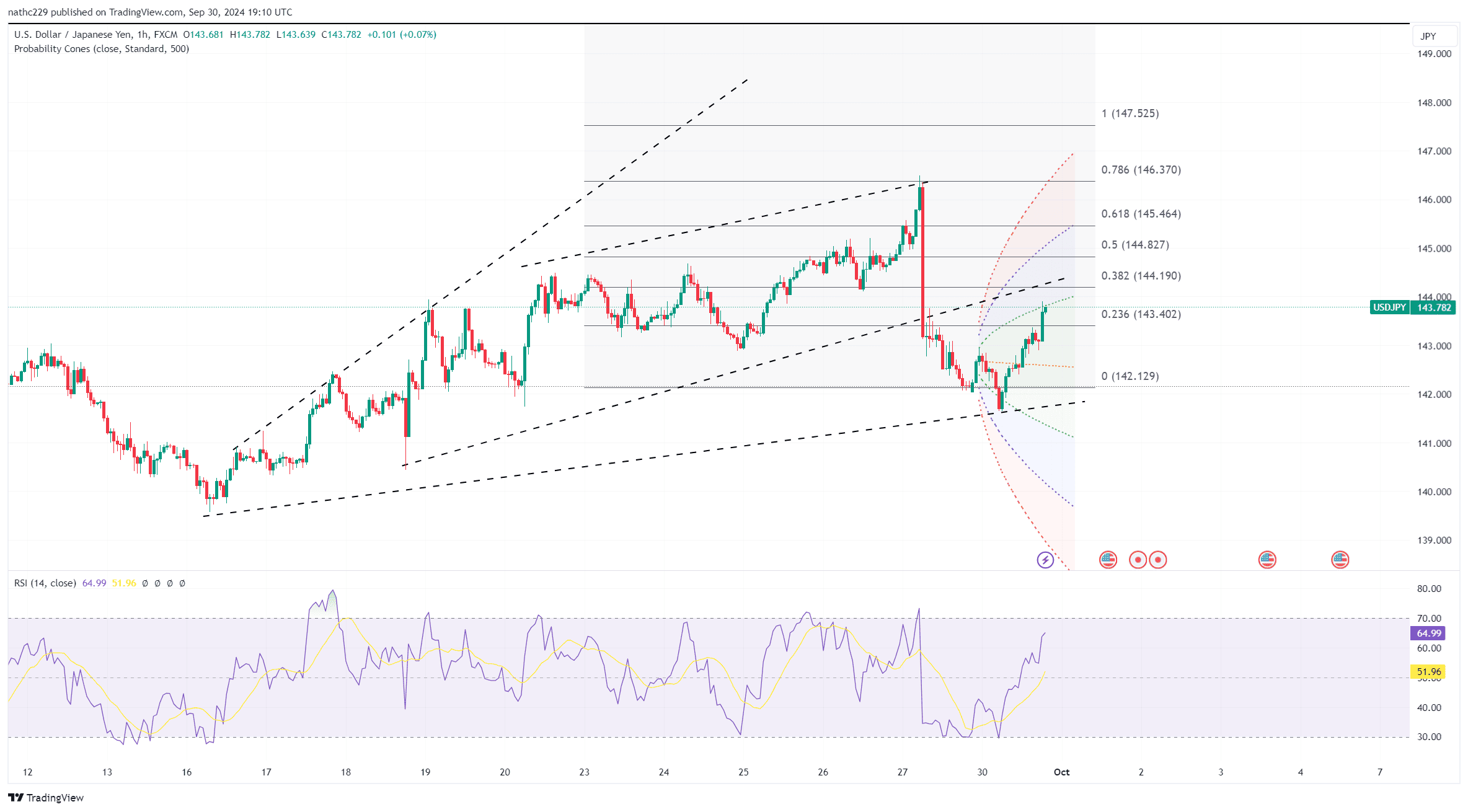

The technical outlook for USD/JPY is decisively bearish, with the daily chart pointing to further downside potential. The pair has already broken below key support at 142, and the next major level to watch is the 2024 low of 139.58. With momentum indicators in negative territory and the pair trading below key moving averages, the bearish bias remains intact. Yen strength has been exacerbated by risk aversion across global markets, as evidenced by the tandem movements in USD/JPY and EUR/JPY. Investors are increasingly cautious as Ishiba’s policies, particularly his stance on fiscal discipline and monetary easing, suggest a shift in Japan’s economic approach.

Moving forward, USD/JPY faces heightened downside risks as Japan prepares for an election on October 27. Ishiba’s call for the election adds to political uncertainty, and his potential to shift the BoJ’s policy could drive further yen appreciation. The bearish sentiment surrounding USD/JPY could be amplified if global risk appetite continues to falter, particularly in light of rising JGB yields and weak economic data. As traders monitor developments, the pair could break below 141, with 139.58 becoming the next key target if bearish momentum intensifies.