The EUR/USD currency pair exhibits a moderate increase to 1.0728

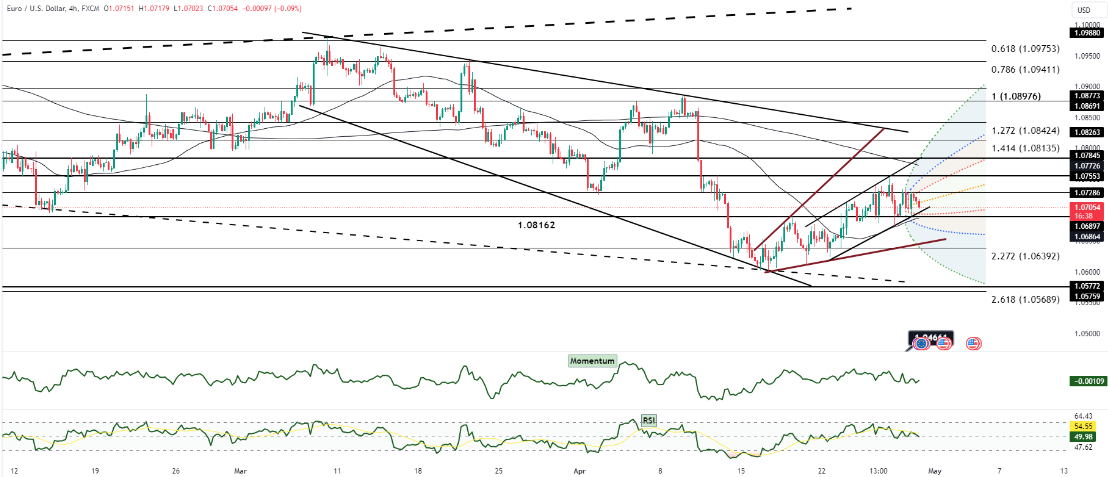

The EUR/USD currency pair exhibits a moderate increase to 1.0728 following the release of US GDP data, indicating a positive market reaction driven by robust economic indicators, particularly the higher-than-expected PCE component. Despite limited trading activity within a narrow range of 1.0710 to 1.0730, the pair faces significant resistance at 1.0740, while the 20-day moving average at 1.0660 acts as key support. Market sentiment is moderately positive, with 55% expressing optimism influenced by strong GDP data, but 25% maintain a negative view, and 20% are neutral. The upcoming Federal Reserve interest rate decision holds significant implications for market dynamics, with hawkish signals potentially strengthening the dollar and dovish signals weakening it.

The EUR/USD currency pair experiences a moderate increase to 1.0728 post-US GDP data release, indicating a positive market reaction to robust economic indicators.

Despite limited trading activity within a narrow range of 1.0710 to 1.0730, significant resistance is observed at 1.0740, while the 20-day moving average at 1.0660 acts as key support.

Market sentiment is moderately positive, with 55% expressing optimism driven by strong GDP data. However, 25% maintain a negative view, and 20% are neutral, reflecting uncertainty and caution in the market.

The upcoming Federal Reserve interest rate decision holds significant implications for market dynamics, with hawkish signals potentially strengthening the dollar and dovish signals weakening it, impacting the EUR/USD pair.

The EUR/USD pair's moderate increase post-US GDP data release indicates a positive market reaction driven by robust economic indicators. Despite limited trading activity, significant resistance at 1.0740 and support at 1.0660 are noted. Market sentiment is moderately positive but tempered by uncertainty, with the upcoming Federal Reserve interest rate decision expected to influence market dynamics significantly.