Sterling Struggles Near Key Support as Central Bank Policies Take Center Stage

GBP/USD traded near its recent trend lows on Wednesday, anchored by support at 1.3060 as traders await more information on the rate paths of the Federal Reserve and the Bank of England (BoE). The pair has been under pressure following the Fed’s 50 basis point rate cut last month, which was framed as a recalibration to address diminished inflation pressures. Traders are closely watching the minutes of the Fed’s September meeting for further clues on how the U.S. central bank plans to proceed with its rate policy. Sterling has also been weighed down by comments from BoE Governor Andrew Bailey, who hinted that the bank could adopt a more aggressive easing stance if UK inflation trends lower. For now, the BoE maintains a cautious approach, keeping rate cuts gradual as inflation remains above target.

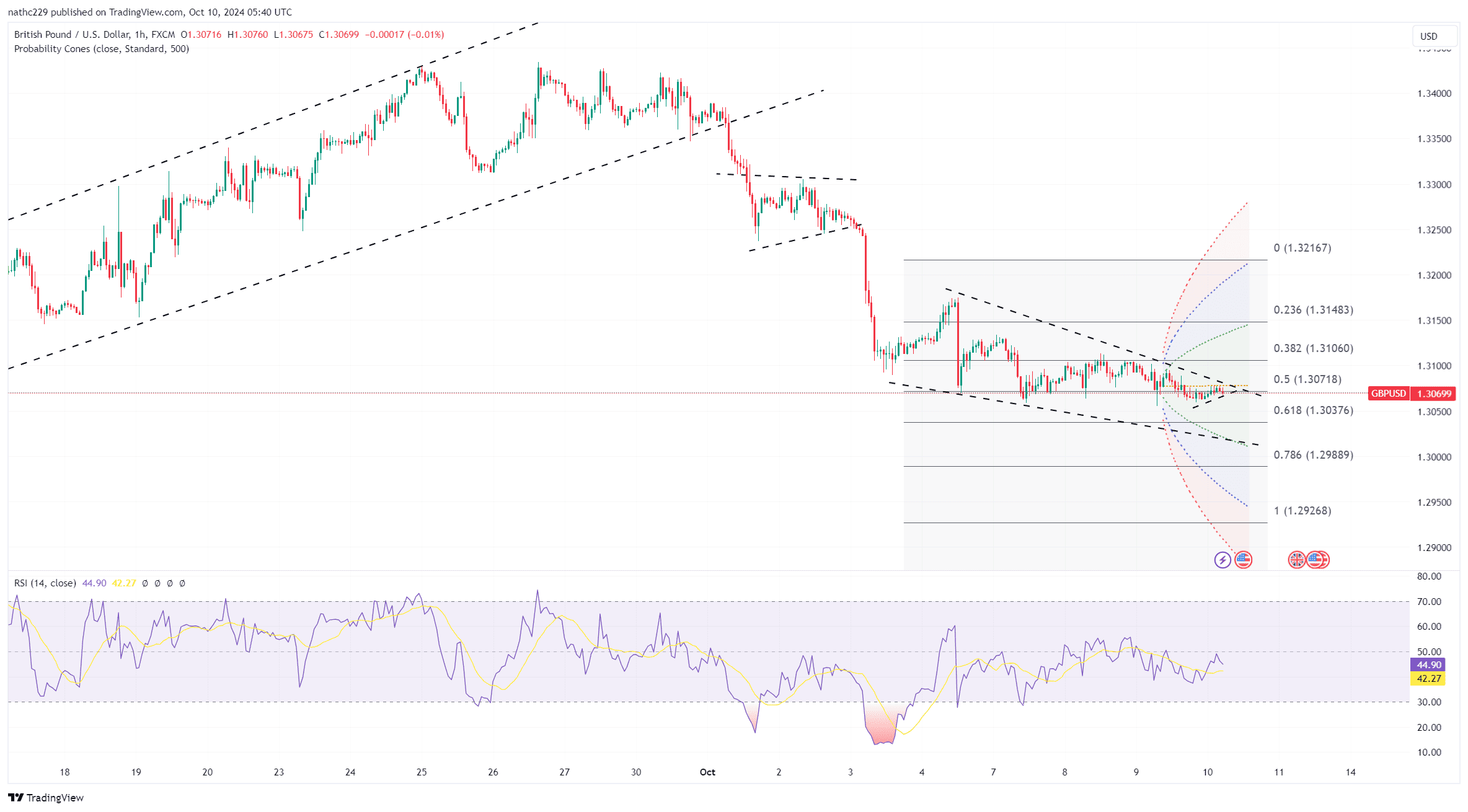

From a technical standpoint, GBP/USD remains in a vulnerable position, trading between 1.3104 and 1.3057. Key support levels include the recent low at 1.3057, followed by the September 11 low of 1.3002 and the daily Ichimoku cloud base at 1.2941. A break below the 50% Fibonacci retracement level at 1.3050 would reinforce the bearish structure, potentially paving the way for a move toward the 1.2666 post-BoE cut lows. The falling daily RSI indicates that downward momentum remains intact, while the 1.3000 level serves as a critical psychological threshold that could trigger further selling pressure if breached. On the upside, resistance is seen at 1.3113 and 1.3174, with the 30-day moving average at 1.3199 offering a more significant hurdle for any recovery attempts.

The outlook for GBP/USD remains uncertain, with traders seeking clearer signals from the Fed and BoE before committing to new positions. If the Fed minutes suggest a more measured pace of easing, it could bolster the dollar and keep pressure on GBP/USD, especially in light of Bailey’s comments hinting at the potential for faster BoE rate cuts. A shift in market sentiment towards a more dovish BoE could lead to a reduction in speculative long positions, amplifying the pound’s downside risks. Meanwhile, any surprise strength in UK economic data could provide temporary relief for sterling, but broader risks remain skewed toward further weakness as long as central bank policy divergence persists.