GBPUSD pulls back from recent lows, key data risks include Friday PCE Data

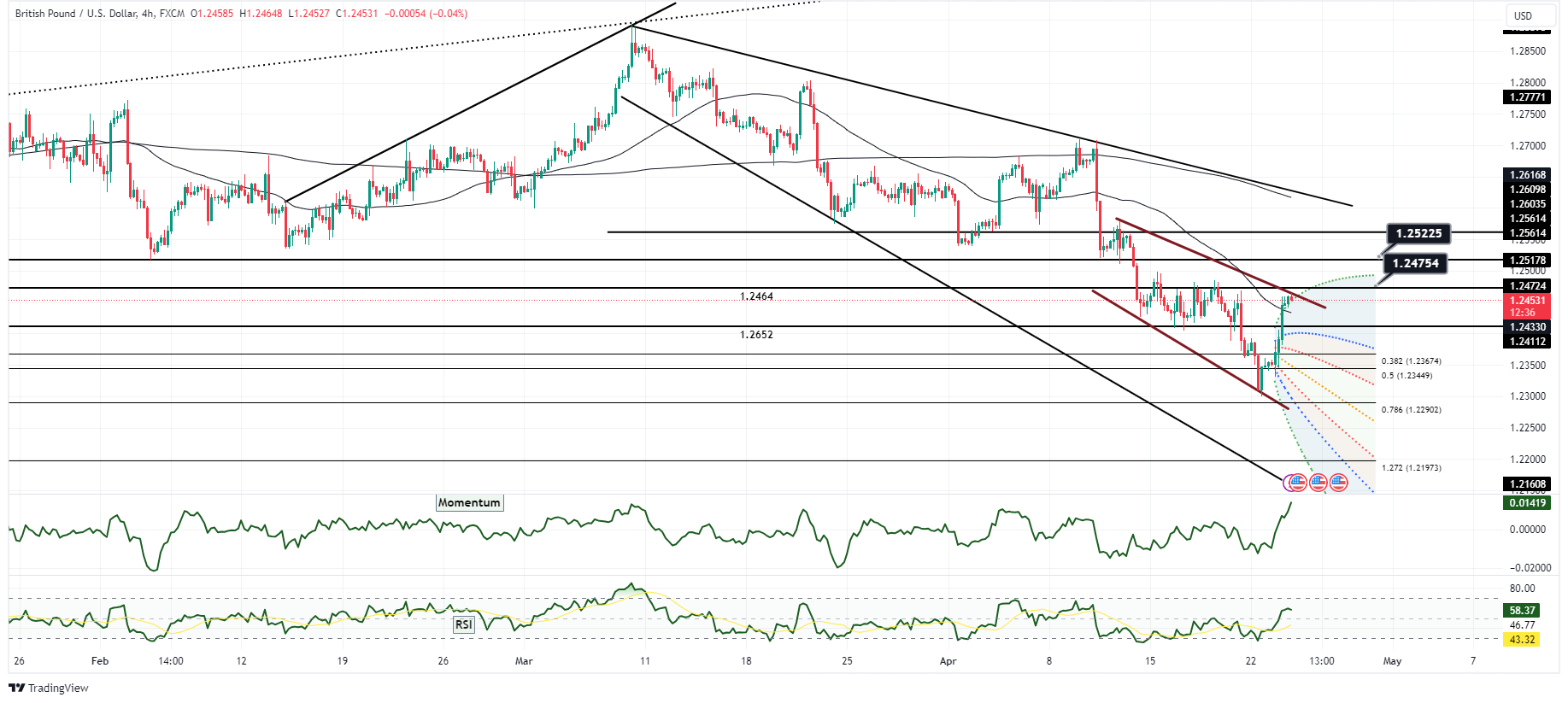

As of April 24, 2024, GBP/USD exhibits a consolidation pattern above the critical psychological level of 1.0700, suggesting the formation of a potential short-term base. The currency pair's recent movements have been influenced by a decrease in U.S. Treasury yields, leading to downward pressure on the U.S. dollar. Technical analysis indicates a temporary bottom with the closure above the 10-day moving average at 1.0660, reinforcing a short-term bullish bias. Resistance levels are observed at 1.0730/40, with a decisive breakout above 1.0780 potentially triggering a more pronounced rally. On the support side, the recent five-month low around 1.2390 remains significant, with further bearish momentum possible below this level. Market sentiment leans towards the negative due to the strength of the USD, supported by firmer U.S. yields, overshadowing positive UK payroll and wage data. Anticipation of key U.S. economic releases adds to the cautious market stance.

Introduction: GBP/USD has displayed a consolidation pattern above 1.0700, hinting at the formation of a potential short-term base amid recent dynamics influenced by U.S. Treasury yields.

Technical Analysis: The closure above the 10-day moving average at 1.0660 suggests a temporary bottom, reinforcing a short-term bullish bias. Stability above 1.0700 and a slight uptrend during trading sessions further support this sentiment.

Resistance Levels: Attention is drawn to 1.0730/40, where the 20-day MA converges with the 38.2% Fibonacci retracement of the March-April decline. A breakout above 1.0780 could trigger a significant short-covering rally, altering the short-term trend.

Support Levels: The recent five-month low around 1.2390 serves as a crucial threshold, with potential for further bearish momentum below this level. Subsequent support is anticipated at 1.2420.

Market Sentiments: With 50% negative sentiment, the market is cautious due to the strength of the USD, supported by firmer U.S. yields. Positive UK payroll and wage data are overshadowed by anticipation of key U.S. economic releases.

Conclusion: GBP/USD's consolidation pattern above 1.0700 suggests a potential short-term base formation, influenced by U.S. Treasury yields. Technical analysis indicates a temporary bottom, with resistance observed at 1.0730/40 and support at 1.2390. Market sentiment leans towards the negative amid anticipation of significant U.S. economic releases.