GBP/USD Reaches Intra-Week High Amid Strong UK Services CPI; BoE Rate Decision Looms

The GBP/USD pair, commonly known as "Cable," has recently experienced significant fluctuations, driven by both technical and fundamental factors. This analysis aims to provide a comprehensive overview of the recent movements and potential future trends of the pair.

UK Services CPI Data: The UK services CPI came in higher than expected at 5.7% year-on-year, surpassing the forecasted 5.5%. This increase in services CPI suggests persistent inflationary pressures within the UK's service sector. The overall UK CPI rose by 2.0% year-on-year, meeting expectations and hitting the Bank of England's (BoE) target for the first time since 2021.

Bank of England's Rate Decision: The BoE is anticipated to hold rates for the 7th consecutive time, two weeks before the UK general election. Markets are currently pricing a 68% chance of the BoE maintaining rates in August, up from 54% earlier in the week. This shift was influenced by the higher-than-expected services CPI print. However, a recent Reuters poll indicated that 63 out of 65 economists expect the BoE to cut rates by 25 basis points to 5% on August 1, four weeks after the election.

Political Landscape: According to an Ipsos poll, the Labour Party is projected to win 453 out of 650 seats, while the Conservatives are expected to secure 115 seats. The political outcome could influence economic policies and subsequently impact the GBP.

Market Sentiment: Traders are closely monitoring the BoE's upcoming rate decision. If additional Monetary Policy Committee members join Dave Ramsden and Swati Dhingra in voting for a rate cut, it could narrow the gap between market expectations and economists' forecasts, negatively affecting the GBP.

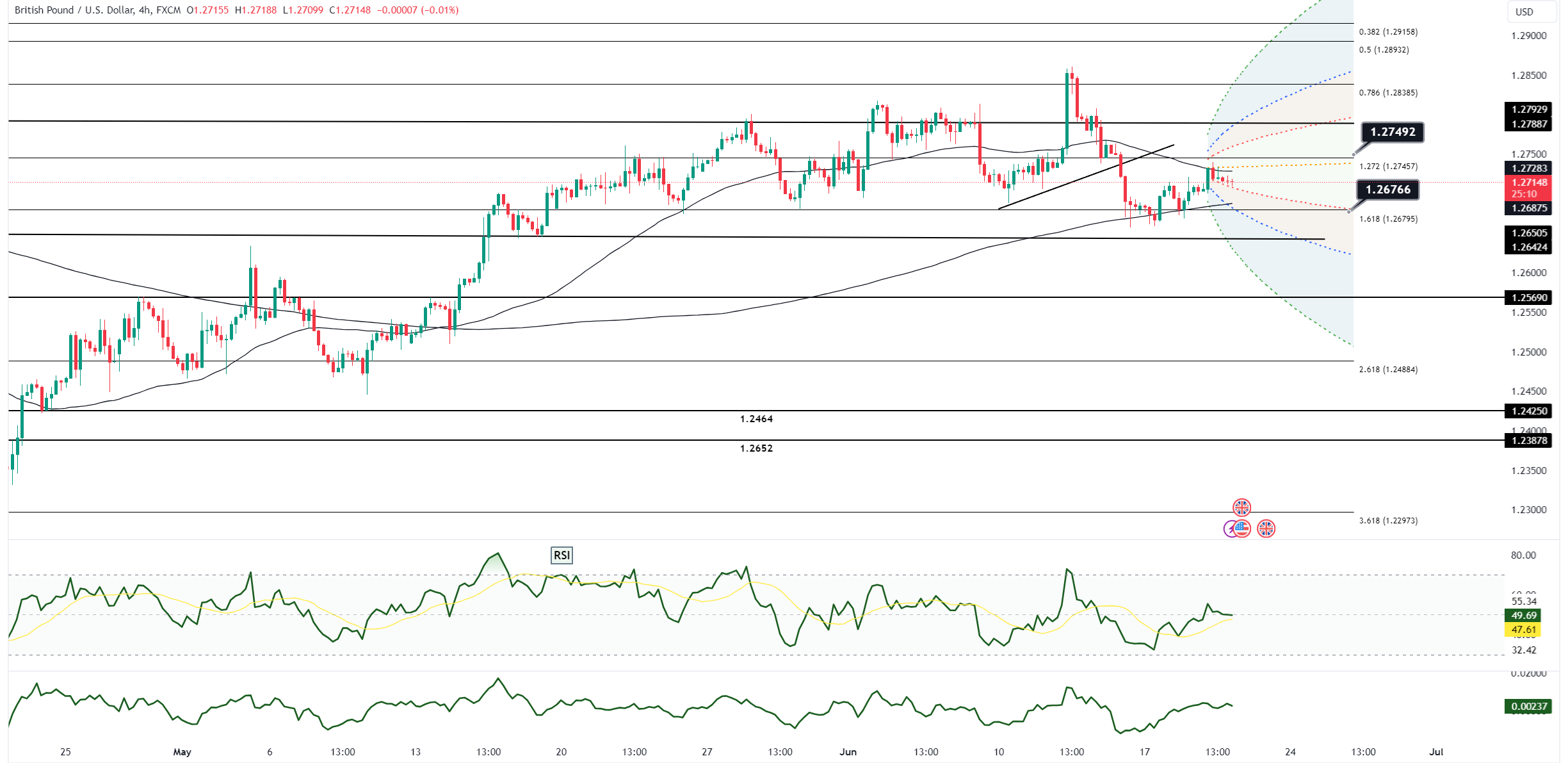

Current Price Levels: GBP/USD reached an intra-week peak of 1.2729 following the release of the higher-than-expected services CPI data. The intra-week high is 1.2733, with the Asia range (pre-UK CPI data) between 1.2701 and 1.2711.

Resistance Levels: Key resistance levels are noted at 1.2742 (21-day moving average) and 1.2763 (June 14 high). These levels could act as barriers to further upward movement unless significant bullish momentum is observed.

Support Levels: If the pair retraces, potential support levels to watch include the lower bound of the recent Asia range at 1.2701. Further support might be found at psychological levels such as 1.2650 and 1.2600.

Outlook

The GBP/USD pair is currently navigating a complex landscape characterized by inflationary pressures, political uncertainty, and diverging expectations regarding BoE's monetary policy. The higher-than-expected services CPI has bolstered the GBP in the short term, but the looming BoE rate decision and the UK's political climate add layers of uncertainty.

Traders should remain vigilant, closely monitoring upcoming economic data releases and BoE announcements. The potential for rate cuts, if materialized, could lead to significant repositioning by traders, affecting GBP/USD and related currency pairs.

In summary, while the technical indicators suggest potential for further gains, the fundamental backdrop presents mixed risks that could lead to increased volatility in the GBP/USD pair in the coming weeks.

Open an account today to unlock the benefits of trading with CMS Financial