"GBP/USD Pauses Near 1.2700 After Soft CPI Data, Eyes on May 22 UK Inflation Report for BoE Clues

Sterling bulls hit a pause near the 1.2700 mark after reaching a five-week high of 1.2701 early Thursday. This temporary exhaustion followed the release of softer-than-expected CPI and retail sales data on Wednesday, which tempered gains and set the stage for cautious trading ahead of the UK inflation data scheduled for May 22. Despite pre-CPI concerns about inflation approaching the Federal Reserve's 2% target, Fed rate expectations have remained stable. With both core and headline inflation rates falling, these worries have eased, shifting focus to September for the Fed's first potential rate cut. Meanwhile, downward pressure on the pound has been intensified by MPC member Megan Greene's less hawkish stance on UK inflation and rate expectations. Greene highlighted increased uncertainty about inflation and did not rule out the possibility of a BoE rate cut in June, contingent on the upcoming UK CPI data.

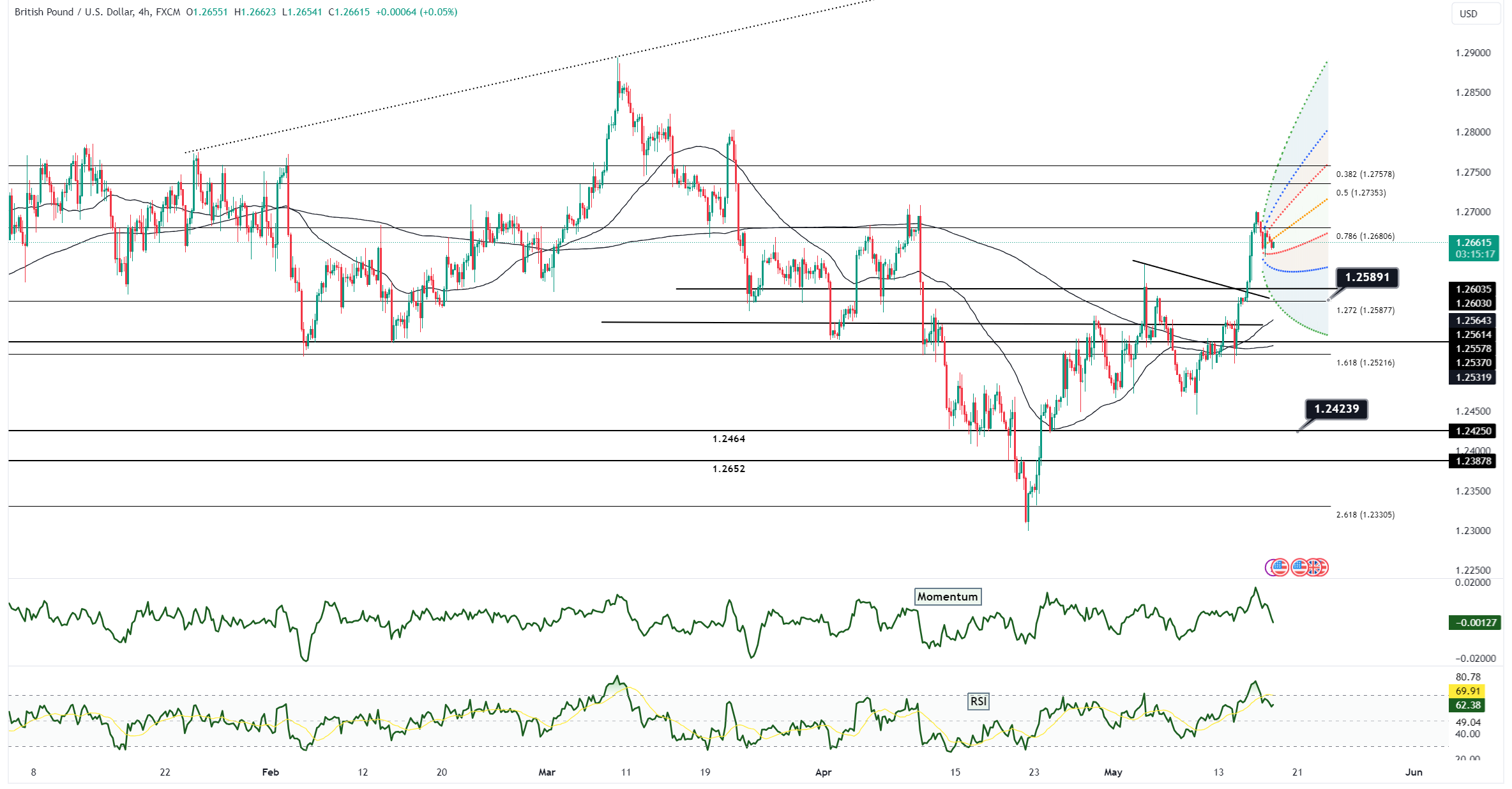

The GBP/USD pair ended North American trading down 0.1% at 1.2675, with Thursday's trading range oscillating between 1.2700 and 1.2650. The pair encountered resistance at the 1.2700 level, coinciding with the Asia session high, following the soft CPI and retail sales data on Wednesday. The upcoming UK CPI report on May 22 is critical for gleaning clues on BoE policy direction, especially in light of Greene's recent comments suggesting a less aggressive stance. Key resistance levels are noted at 1.2700, 1.2712, and 1.2745, while support levels are identified at 1.2640, 1.2630 (corresponding to the 100-day moving average), and 1.2595. Market participants will closely monitor these levels, with the 1.2700 resistance proving pivotal in determining the next leg of the GBP/USD movement.