GBP/USD Faces Downward Pressure Amid Hawkish Fed Stance and Strengthening USD

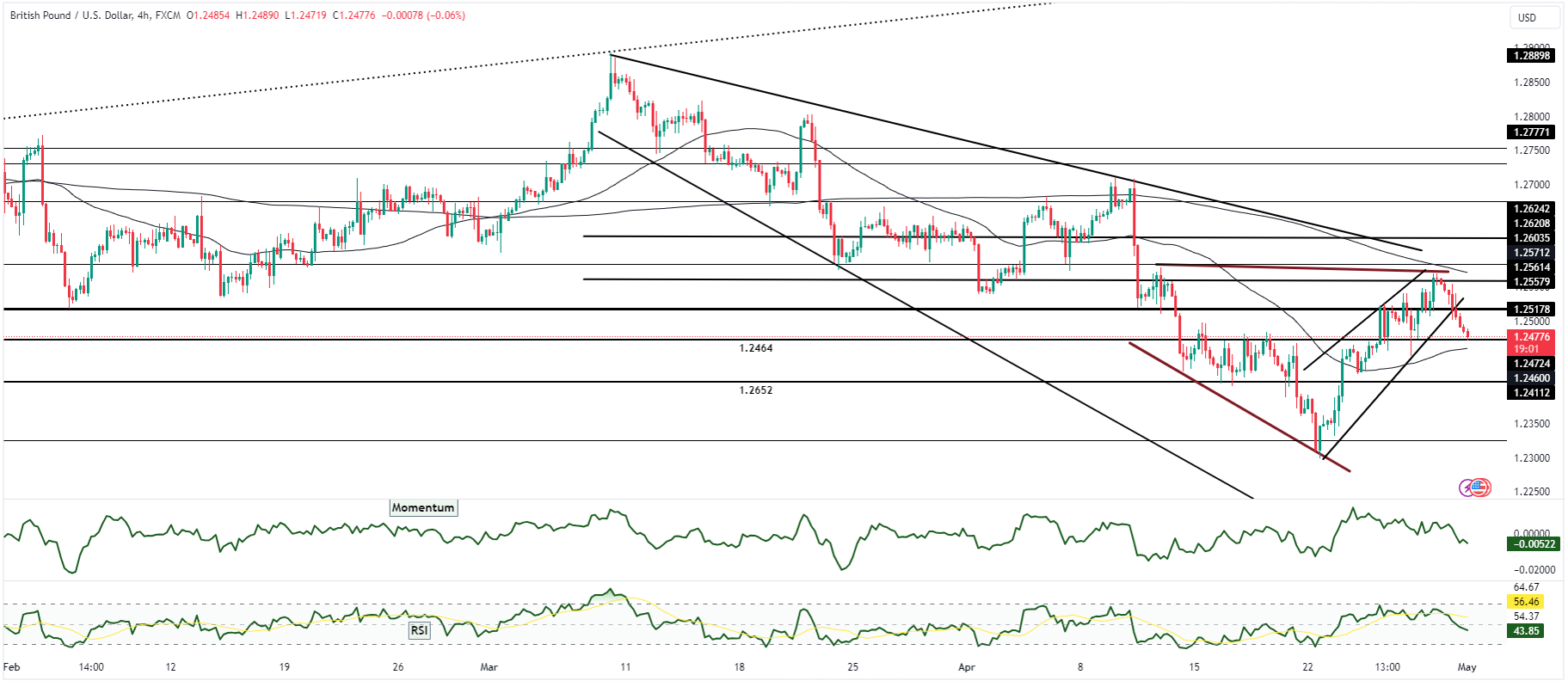

The recent trading activity in GBP/USD indicates a downward trend, evidenced by a 0.5% decline and a test of the critical support level at 1.25. Notably, the pair has fallen below its 200-day moving average, suggesting a potential shift in market trend. The relative stability in EUR/GBP suggests that the movement in GBP/USD is primarily driven by USD strength, highlighting the significant influence of the US dollar in current market dynamics.

From a broader perspective, macroeconomic concerns are dominated by the Federal Reserve's increasingly hawkish stance, which has contributed to the rise of the USD by pushing yields higher and heightening market expectations for future rate hikes. This view is further supported by the recent release of the U.S. Q1 Employment Cost Index, reinforcing the likelihood of continued monetary tightening by the Fed. The anticipation of month-end dollar buying adds to the strength of the USD narrative.

Looking forward, a sustained break below the 1.25 level in GBP/USD could lead to further declines, with the next support zone anticipated between 1.2451 and 1.2460. Additionally, the forthcoming Federal Reserve meeting casts a shadow over the potential for any significant recovery in Sterling in the short term, as market participants await possible policy adjustments that could enhance the USD's dominance in global markets.