GBP/USD Bears Regain Control as Home Price Data Disappoints, Downtrend Resumes

GBP/USD fell to a one-month low as sterling bulls were left wanting after the latest batch of UK home price data failed to meet expectations. Despite a 0.3% increase in September and the strongest year-on-year rise since November 2022, the softer-than-expected figures did little to boost market sentiment. This aligns with BoE Governor Andrew Bailey's recent comments that rate cuts might accelerate, contrasting with Chief Economist Huw Pill's more cautious stance on monetary easing. The market’s focus remains on the relative strength of the U.S. economy, where positive surprises in economic data have supported the dollar, while UK data prints have lagged. These factors, combined with geopolitical uncertainties and looming U.S. elections, have made investors reluctant to add to their long pound positions.

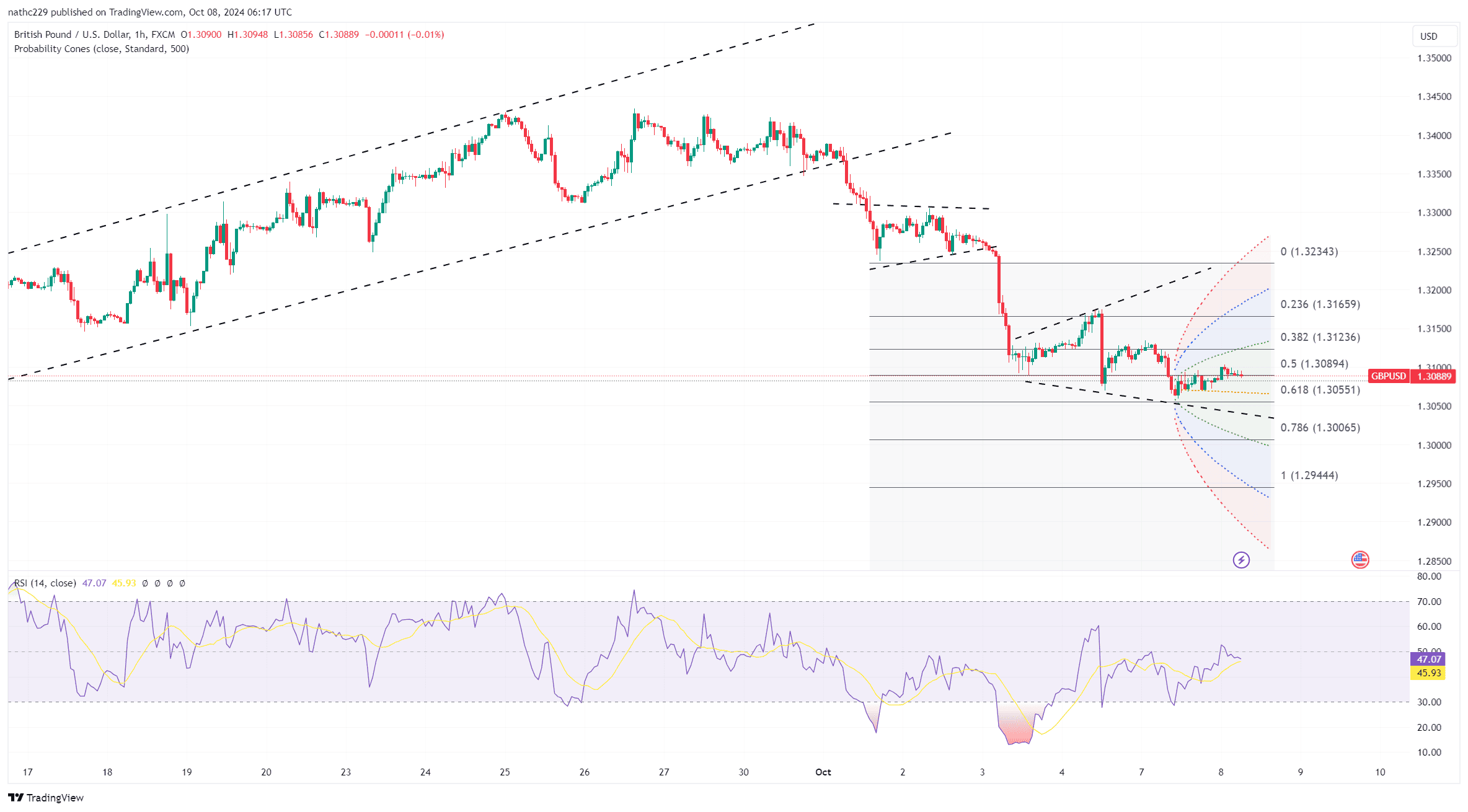

From a technical standpoint, GBP/USD is exhibiting bearish signals, with Monday's price drop following a daily doji pattern that initially suggested a pause in the downtrend. This move indicates that the doji was not a reversal signal but rather a temporary pause before further downside. The daily RSI is trending lower, suggesting that there is still room for further declines before reaching oversold conditions. The pair remains below key levels, including the 1.3000 psychological support, and is capped by the rising daily Ichimoku cloud top, which acts as a significant resistance level. The probability has increased that GBP/USD will test its September low, and a break of this level could open the door to further declines.

Looking forward, the technical outlook for GBP/USD points to a higher probability of continued downside, especially if the pair fails to hold above 1.3000. A decisive break below this level could lead to increased selling pressure, with support near 1.2800 and the 200-day moving average becoming potential targets for bears. The options market is reflecting this risk, with one-month skews showing the most bearish outlook for the pound since June. With speculative long positions in the pound nearing elevated levels, the risk of a deeper correction looms if the downtrend persists and traders start to unwind those positions. Investors will also keep a close eye on the upcoming UK budget announcement and external geopolitical developments, which could further influence the pair’s trajectory.