GBP/USD Awaits CPI for Clarity on BoE’s Rate Path After Employment Data Boost

GBP/USD remained near the top of its recent trading range, hovering around 1.31 after UK employment and wage data came in slightly above forecast. The stronger data initially provided a boost to sterling, reducing expectations for aggressive BoE rate cuts, but the rally lost steam ahead of Wednesday’s CPI release. The market had previously priced in a dovish shift following Governor Andrew Bailey’s comments about the potential for more accommodative policy. However, if inflation data on Wednesday shows persistent price pressures, expectations for further BoE easing could diminish, shifting sentiment in favor of sterling.

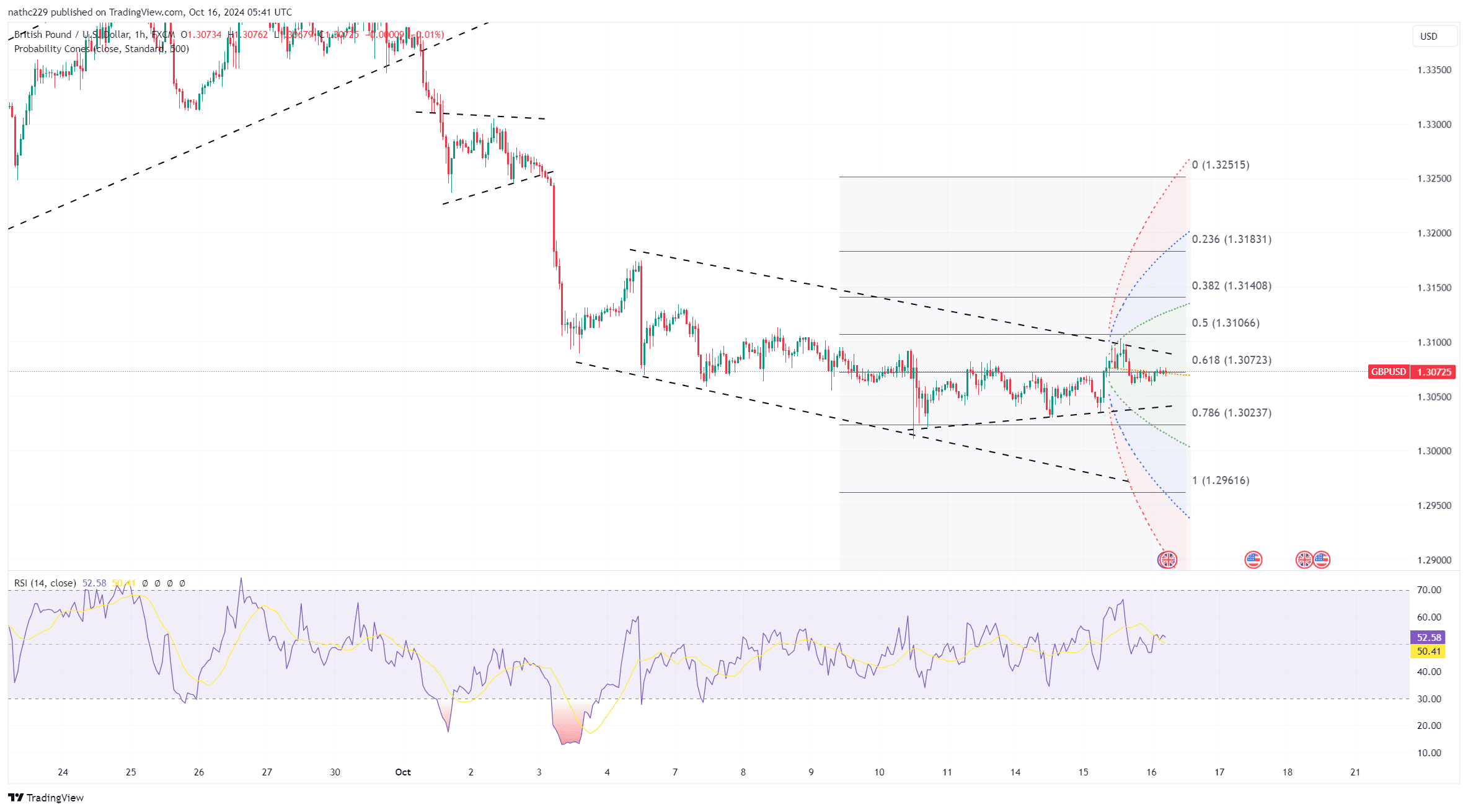

Technically, GBP/USD faces immediate resistance at 1.3103, Tuesday’s high and the 10-day moving average, with further resistance seen at 1.3148, the daily Tenkan line, and 1.3174, the October 8 high. A break above these levels could open the door to a retest of the 21-DMA at 1.3218 and the October 3 high at 1.3285. On the downside, support lies at 1.3038, followed by 1.3011, the low from October 10, and 1.3002, the low from September 11. A sustained break below the 1.3000 level would reinforce the bearish structure, potentially leading to further declines.

With inflation data in focus, Wednesday’s CPI release will play a pivotal role in shaping market expectations for BoE policy. An upside surprise would likely reduce the probability of BoE rate cuts, supporting GBP/USD and shifting focus toward resistance at 1.3174. On the other hand, softer CPI readings would likely revive expectations for rate cuts, with the market already assigning an 80% probability to a 25-bps cut at the November 7 meeting. In such a scenario, GBP/USD could slip below 1.3000, with bearish momentum likely extending toward deeper support levels.