EUR/USD Temporary Rebound Likely Capped by Persistent U.S. Dollar Yield Advantage

EUR/USD edged higher on Thursday after ECB policymaker Joachim Nagel cautioned against a hasty rate cut approach, underscoring the ECB’s resolve to combat inflation. However, the rally in EUR/USD may prove temporary as interest rate differentials and diverging economic growth outlooks continue to support the U.S. dollar. The latest data from French, German, and eurozone PMIs underscored ongoing challenges to economic growth, contrasting with stronger U.S. PMI data, which beat expectations. Cleveland Fed President Beth Hammack reiterated that the Fed’s job to curb inflation remains incomplete, suggesting a gradual rate cut path ahead and boosting the dollar’s relative appeal. German-U.S. yield spreads expanded to their widest point since April, with a -161.5bps gap in terminal rate expectations favoring the dollar further.

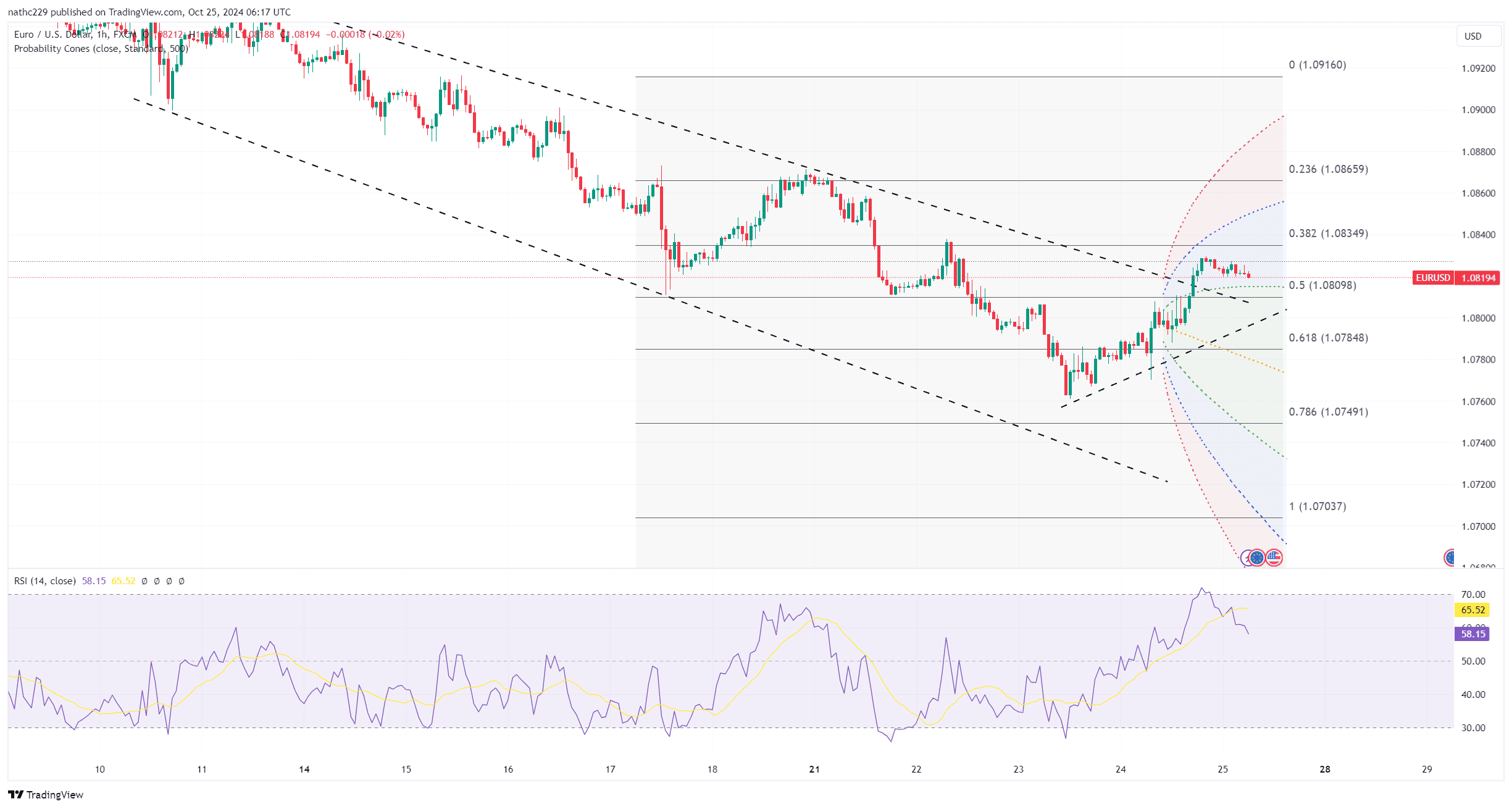

Technically, EUR/USD’s short-term rebound from the 1.0788 low to the 1.0817 area brought it close to its 5-DMA, but the pair remains under pressure below the 200-day moving average. The daily RSI rising from oversold conditions signals a potential for further upside, yet the broader bearish trend, marked by a falling monthly RSI and downward pressure on the 200-DMA, suggests any gains may be limited. Immediate resistance lies at the 1.0820 mark, and a failure to break above this level could see EUR/USD resume its downtrend, with key support in the 1.0770 area.

With German Ifo and U.S. durable goods data on the horizon, as well as comments from Boston Fed President Collins, Friday’s events could renew pressure on EUR/USD if U.S. data shows continued resilience. The underlying trend remains bearish, with the pair likely to face selling interest on rallies as long as economic data and yield spreads support the dollar. While a short-term bounce may extend, EUR/USD appears poised for further declines unless there is a significant shift in the fundamental landscape.