EUR/USD surged to a 7-month high on Wednesday as bullish momentum persisted following the release of U.S. CPI data

EUR/USD surged to a 7-month high on Wednesday as bullish momentum persisted following the release of U.S. CPI data, which sparked renewed debate over the Fed's potential rate cuts in September. The July CPI figures mostly aligned with expectations, with year-over-year headline inflation rising by 2.9%, just shy of the anticipated 3.0%. This fueled investor confidence that disinflation remains on track. However, discussions about whether the Federal Reserve will cut rates by 25bps or 50bps intensified, with CME's FedWatch Tool indicating that the likelihood of a 50bps cut decreased from 55% to around 40%. Despite the lowered probability, market participants still expect the Fed to commence its rate-cutting cycle, which could exert downward pressure on the U.S. dollar.

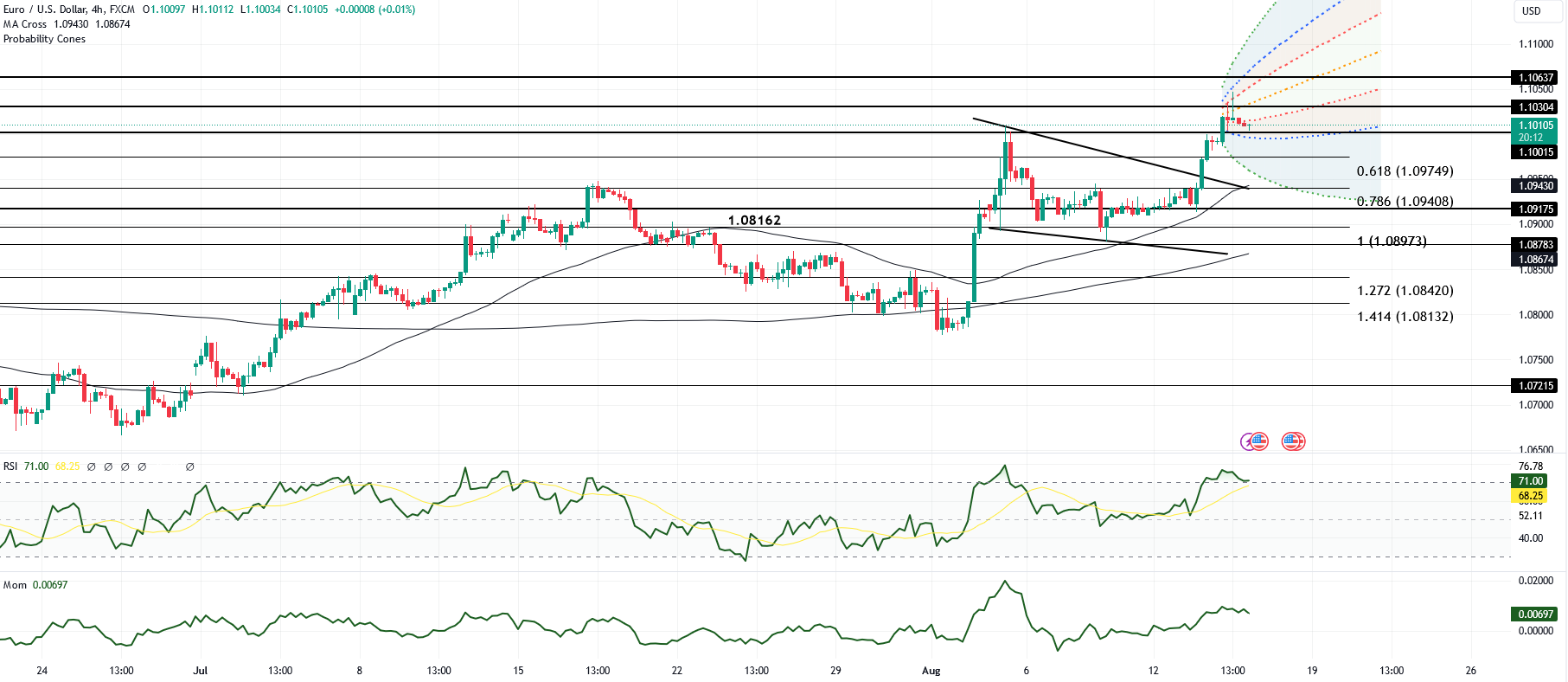

From a technical perspective, EUR/USD's bullish outlook is reinforced by the narrowing German-U.S. yield spreads, which are now at their tightest levels since August 7. The pair's rise above key daily moving averages and the break of the downtrend line from 2023's high signal continued upward momentum. Rising daily and monthly RSI indicators further support this bullish trend. Investors are now closely watching upcoming U.S. economic data, including weekly jobless claims, July retail sales, and the University of Michigan’s consumer sentiment index. Any signs of slowing job growth or weakening consumer activity could lead to heightened expectations for a 50bps rate cut in September, potentially driving EUR/USD above the 1.1100 mark.