EUR/USD Stalls Amid Political Uncertainty and Rising U.S. Yields

The euro experienced a modest reprieve following the first round of the French election, but this relief was short-lived as political uncertainty on both sides of the Atlantic weighed on the market. The French election results were broadly in line with expectations, with the far-right National Rally party unlikely to secure an absolute majority, leading to a probable hung parliament. While this outcome led to a rally in French-exposed assets and initially supported the euro, the high level of uncertainty discourages significant bets on further euro gains. The possibility of an absolute majority for the National Rally party, though slim, cannot be completely ruled out, with the second round of voting results due on July 7.

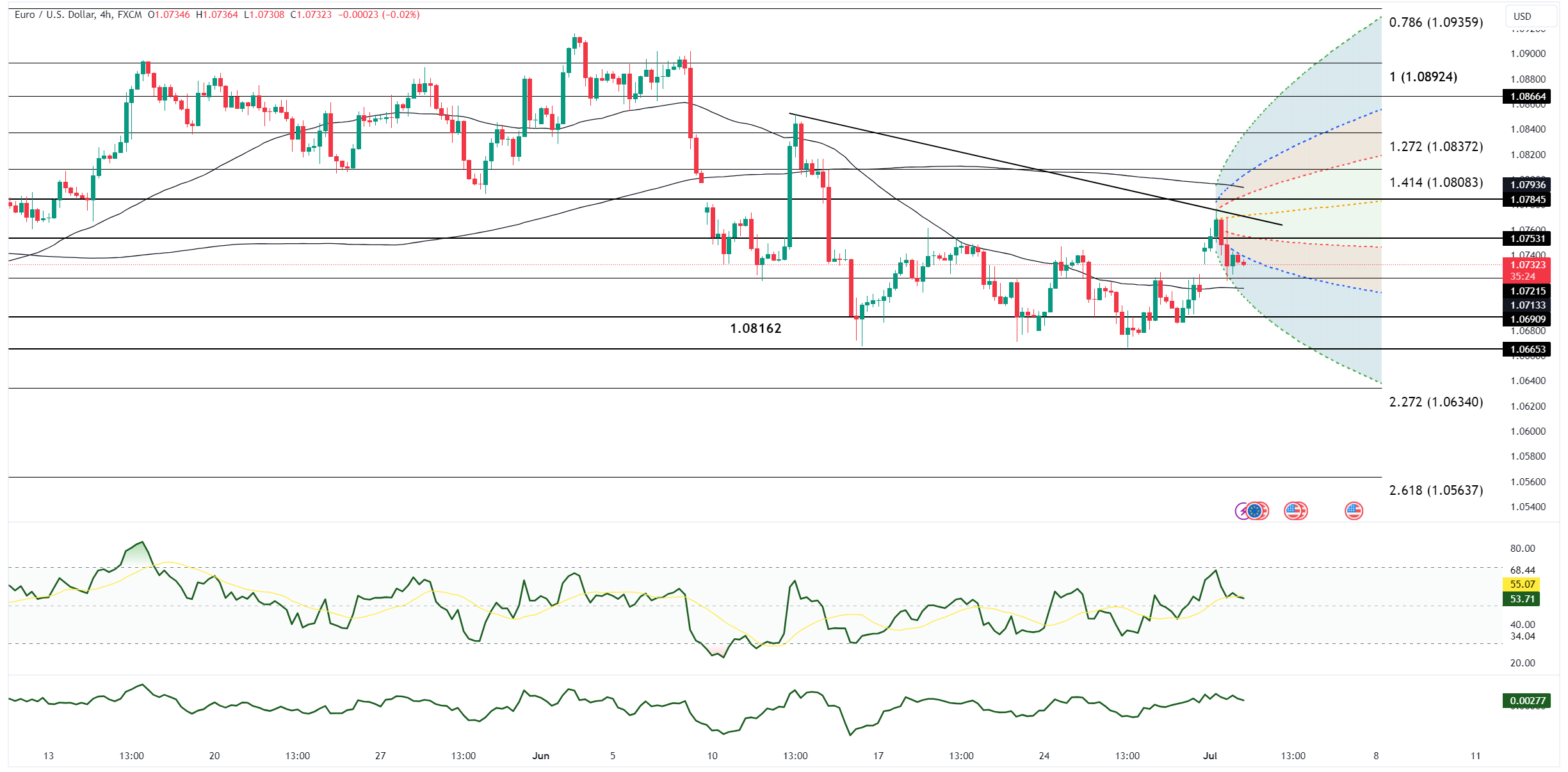

In the U.S., the momentum in higher yields has intensified since the presidential debate, with the benchmark 10-year Treasury yield testing early June highs at 4.48%. The increasing odds of a Donald Trump presidency have led investors to reconsider the implications for trade and fiscal policy, driving yields higher in response. This rise in U.S. yields has contributed to unwinding the initial upside for the euro. EUR/USD has stalled, with U.S. yields dictating the market direction and French election risks lingering.

Currently, the EUR/USD pullback is limited to 1.0718, marking the weekend gap. A break below this level could open the door to the 1.0650-1.0670 range, which contains a cluster of recent lows. While the French election results were better than feared, the persistent uncertainty and the non-negligible risk of a far-right majority set a high bar for sustained euro strength.

Open an account today to unlock the benefits of trading with CMS Financial