EUR/USD Slides on Election-Driven USD Demand, Support Levels in Play Amid High Volatility

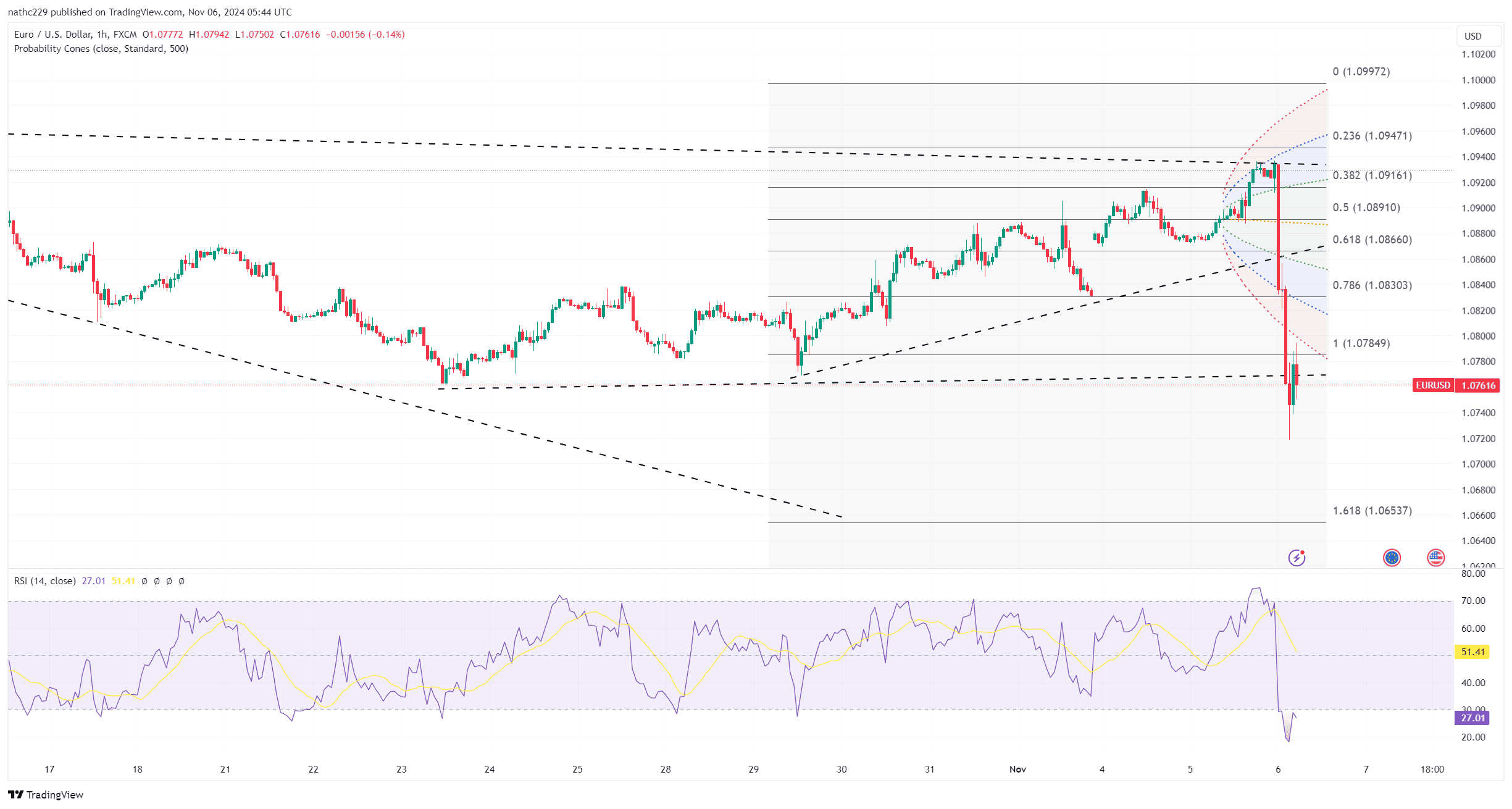

EUR/USD sharply reversed early gains on Tuesday as a strong early lead for Donald Trump in the U.S. election results spurred a wave of dollar demand, pushing the pair down from a high of 1.0937 to a low of 1.0719. The market remains highly volatile and thin, with large option expiries at levels both above and below current prices potentially helping to moderate drastic moves. Significant option expiries include €1.5 billion at 1.0725, €900 million at 1.0750, and €2.4 billion at 1.0800, while bearish technical indicators suggest downside risks remain. The potential for additional downside looms, with October’s low of 1.0762 and the June 26 low of 1.0666 acting as critical levels to watch if the downtrend intensifies.

Technical indicators are showing bearish pressure, with the pair trading below the 5-, 21-, and 200-day moving averages. The formation of lower lows suggests that bears are in control, with immediate support seen at 1.0725 and 1.0762. If EUR/USD breaks below these levels, it could trigger further selling pressure down toward the June low of 1.0666. On the upside, a recovery above 1.0800 would require a more stable risk environment, though such a move may be capped by recent highs if the dollar remains in favor.

With volatility elevated, EUR/USD’s direction remains dependent on election results and any emerging trends in the U.S. dollar’s demand. Investors are closely watching for clarity in the election outcome, but if uncertainty persists, EUR/USD may continue to face downside pressure as traders flock to the safety of the dollar. Conversely, if markets interpret any developments as supportive for global risk sentiment, EUR/USD could bounce back toward its recent highs, supported by broader USD weakness. However, traders should remain vigilant given the uncertain and headline-driven market environment.