EUR/USD Sinks as U.S. Jobs Data Challenges Fed Rate Cut Outlook, Bears Eye 1.0700

EUR/USD tumbled to a fresh two-month low on Friday, driven by robust U.S. non-farm payrolls data and widening yield differentials between the U.S. and Germany. After opening near 1.1025, the pair dropped steadily throughout the session, hitting a low of 1.0951 as U.S. payrolls surprised to the upside, with 254,000 jobs added in September compared to the 140,000 expected. The unemployment rate also fell to 4.1%, which bolstered the dollar by diminishing expectations for aggressive Federal Reserve rate cuts. The widening of the U.S.-German 2-year yield spread further supported the greenback, while EUR/USD struggled under the weight of diverging monetary policy outlooks for the Fed and the ECB.

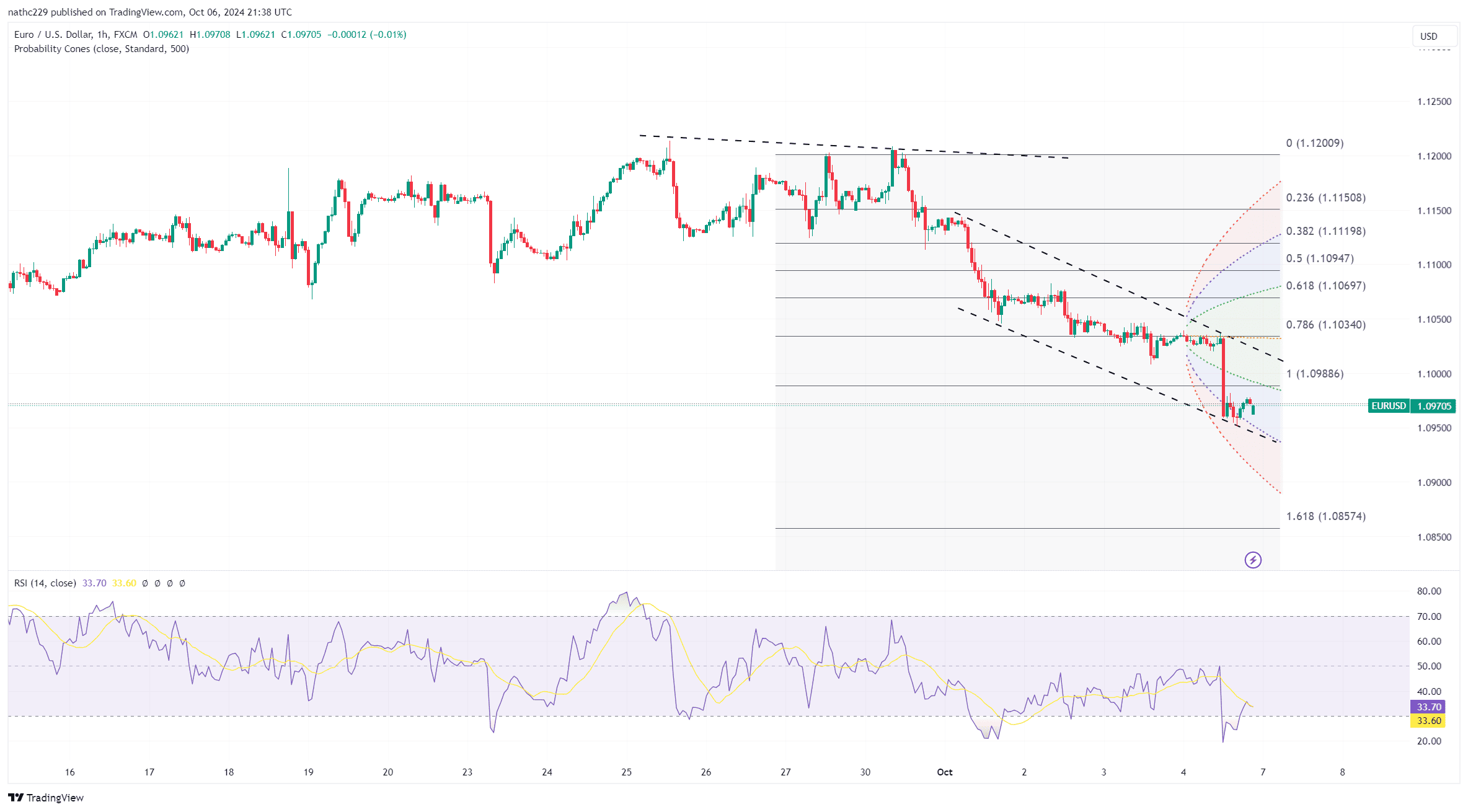

Technically, the outlook for EUR/USD remains bearish, with the pair trading well below key moving averages, including the 5-, 21-, and 55-day DMAs, and the daily Ichimoku cloud. The pair’s failure to hold above 1.1000 has put bears firmly in control, with falling daily and monthly RSIs reinforcing downside momentum. As expectations for aggressive Fed cuts fade, while the ECB appears set to ease further amid sluggish euro zone growth, wider U.S.-German rate spreads will likely limit any upside for EUR/USD. The pair now faces downside targets around the 200-day moving average, with the 1.0650-1.0700 support zone likely to be tested if current trends persist.

Looking forward, EUR/USD’s ability to recover will depend on developments in U.S. monetary policy and economic data. With the Fed’s focus potentially shifting toward a more balanced approach between employment and inflation, the prospect of fewer or slower rate cuts could keep the dollar supported. On the other hand, the ECB’s dovish stance, driven by weak euro zone growth and moderating inflation, could maintain pressure on the euro. If EUR/USD breaks below key support at 1.0700, the bearish trend could accelerate, with limited upside potential unless there is a significant shift in macroeconomic conditions or central bank policy expectations.