EUR/USD Rebounds from 12-Session Low as Market Awaits Key US April PCE Report

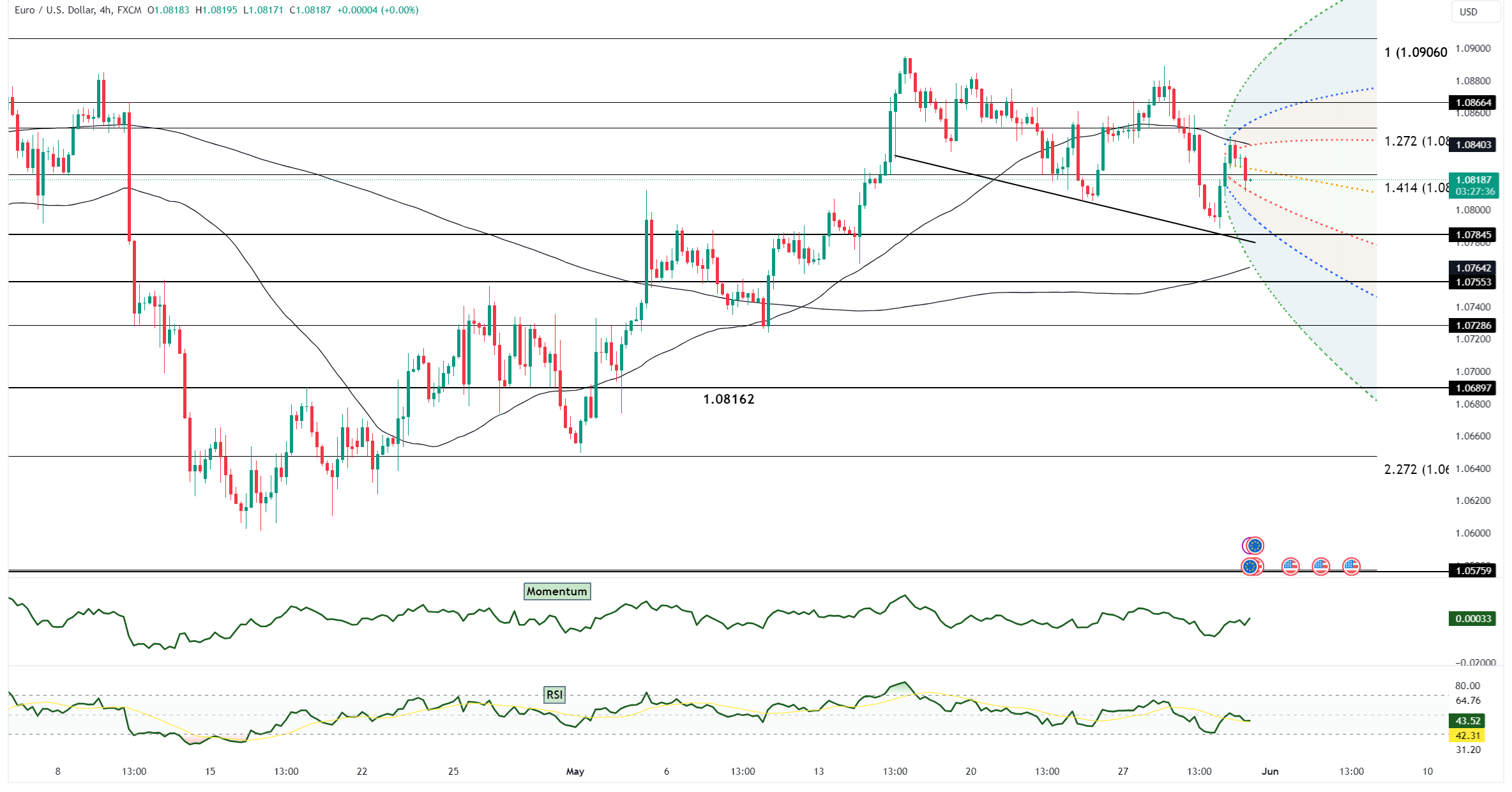

EUR/USD turned positive after hitting a 12-session low on Thursday, with longs benefiting from bullish technical signals. This shift occurred amid lower-than-expected euro zone April unemployment data, suggesting potential economic recovery. The U.S. Q1 GDP was revised down to 1.3%, as expected, while core PCE was adjusted to 3.6% from 3.7%. Additionally, weekly and continuing jobless claims increased. These factors led to softened U.S. yields, tightening the German-U.S. spreads to which EUR/USD is correlated, contributing to the currency pair's reversal higher. Key technical indicators showed a daily RSI divergence on the low and a daily bull hammer formation, which formed after EUR/USD tested and held the daily cloud top and the 200-DMA, adding to its validity. Investors are now focused on the U.S. April PCE report, which could influence the Federal Reserve's stance. The core PCE is expected to match March's results at +0.3% month-on-month and 2.8% year-on-year. A downside surprise could lead to further declines in yields and the dollar, potentially driving EUR/USD above 1.0900 and towards 1.1050/1.1100.

Overnight, EUR/USD fell towards the daily cloud top and the 200-DMA before bouncing back, hitting a low of 1.07885. The pair opened near 1.0815 in New York and extended its rally, supported by the Q1 GDP's PCE revision to 3.6% and increased weekly claims. This data helped push U.S. yields and the dollar down while tightening the DE-US spreads. Additionally, USD/CNH neared 7.2525, gold turned positive, and stocks bounced, contributing to EUR/USD rallying above the 21-DMA, piercing the 10-DMA, and hitting 1.0845 late in the session. The pair traded up by +0.37%, with bullish technical signals emerging. The RSI divergence on the 12-session low and the formation of a daily bull hammer candle were notable. Attention is now on the U.S. April PCE report, which could significantly impact Fed policy. An above-estimate PCE might rally yields and the dollar, sending EUR/USD downward.

Open an account today to unlock the benefits of trading with CMS Financial