EUR/USD Rallies Amid Consolidation Ahead of U.S. PCE Data

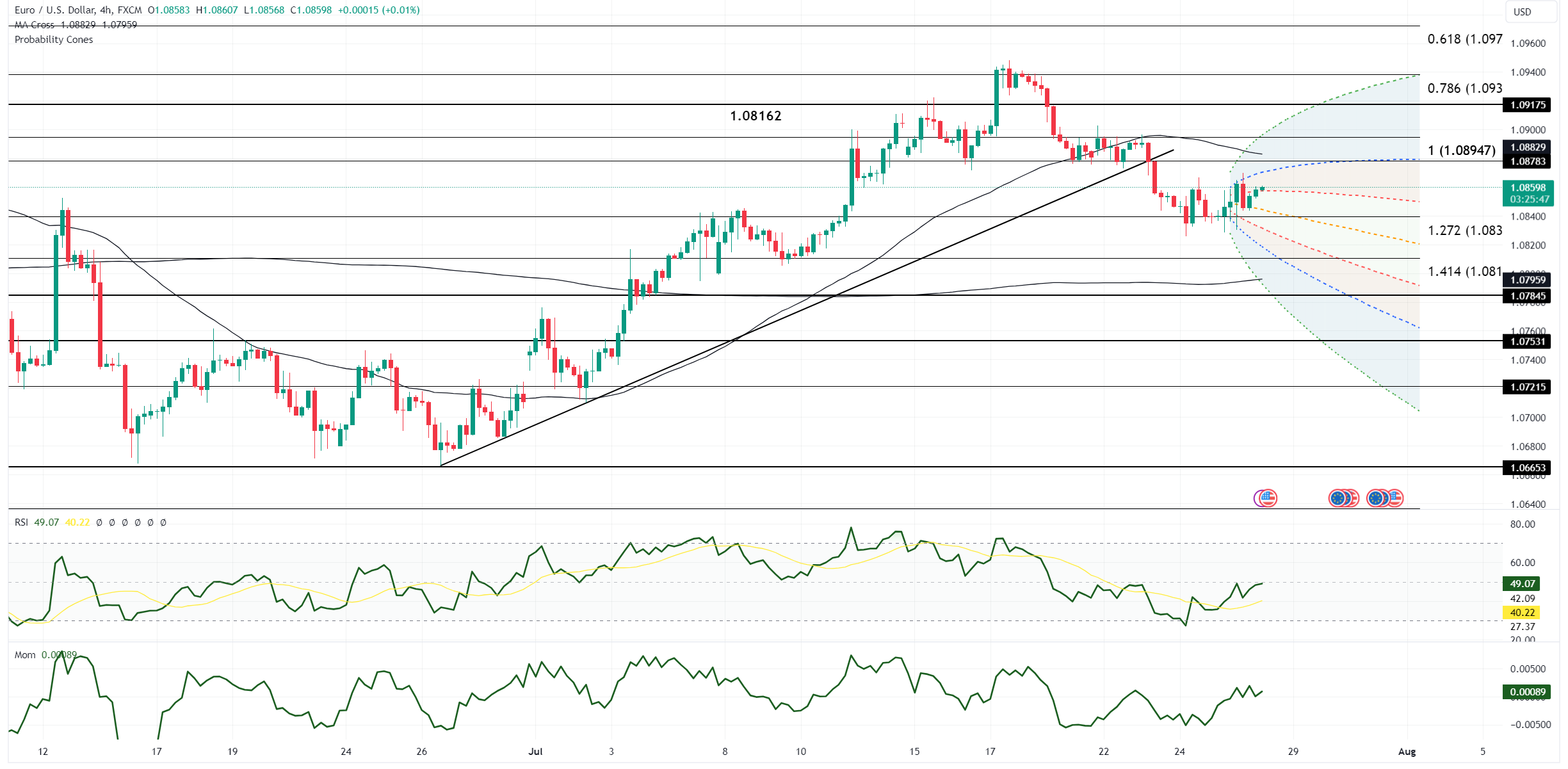

EUR/USD rallied on Thursday, though the manner of trading suggests consolidation is taking place. This may leave investors reliant on the upcoming June U.S. Personal Consumption Expenditures (PCE) report to determine if bearish daily technicals will outweigh longer-term bullish signals. Daily technicals highlight downside risks as the consolidation of the drop from the July 17 daily high persists. EUR/USD continues to trade below the 10-day moving average (DMA) and the thinning daily cloud, which is set to twist on July 31 and could act magnetically.

However, longer-term technicals provide some comfort for EUR/USD longs. The monthly Relative Strength Index (RSI) is rising, and EUR/USD trades above both the 55-DMA and 200-DMA. Monthly charts also show a large bull pennant continuation pattern in place. The upcoming U.S. June PCE, especially the core readings, could disrupt this balance. Month-on-month PCE is estimated at +0.1% from May's 0.0%, while year-on-year is expected to drop to 2.5% from 2.6% in May. The Federal Reserve has been pleased with recent data indicating disinflation, so any upside surprise in PCE could reinforce bearish daily technicals.

An upside beat could significantly rally yields, which have been trending lower since April. Investors may lower the probability of the Fed cutting 75 basis points in 2024, currently trading above 90%. This could widen German-U.S. spreads and increase the dollar's yield advantage over the euro, potentially validating daily technical signals with a sharp downward move in EUR/USD.

In New York trading, EUR/USD opened near 1.0855 and traded up despite overnight risk-off sentiment. The pair neared 1.0830 after U.S. weekly jobless claims, Q2 GDP, and durable goods data. However, bears ran out of steam as risk sentiment improved, leading to a rally. An increase in EUR/JPY from the 165.30 area to 167.575 on EBS also helped lift EUR/USD. Rallies in oil and stocks into positive territory buoyed risk assets, while lower U.S. yields helped lift risk and rally EUR/USD to 1.0870. The pair pulled back slightly to near 1.0860 and traded up 0.20% late in the session.

Technicals lean bullish with rising RSIs, and the pair held above both the 200- and 55-DMAs. Upcoming data, including Tokyo's July CPI and the U.S. June PCE, and their impact on Fed and BoJ policy remain key risks to watch.

Open an account today to unlock the benefits of trading with CMS Financial