EUR/USD Hits Four-Month High Amid Investor Indecision and Upcoming U.S. Data Focus

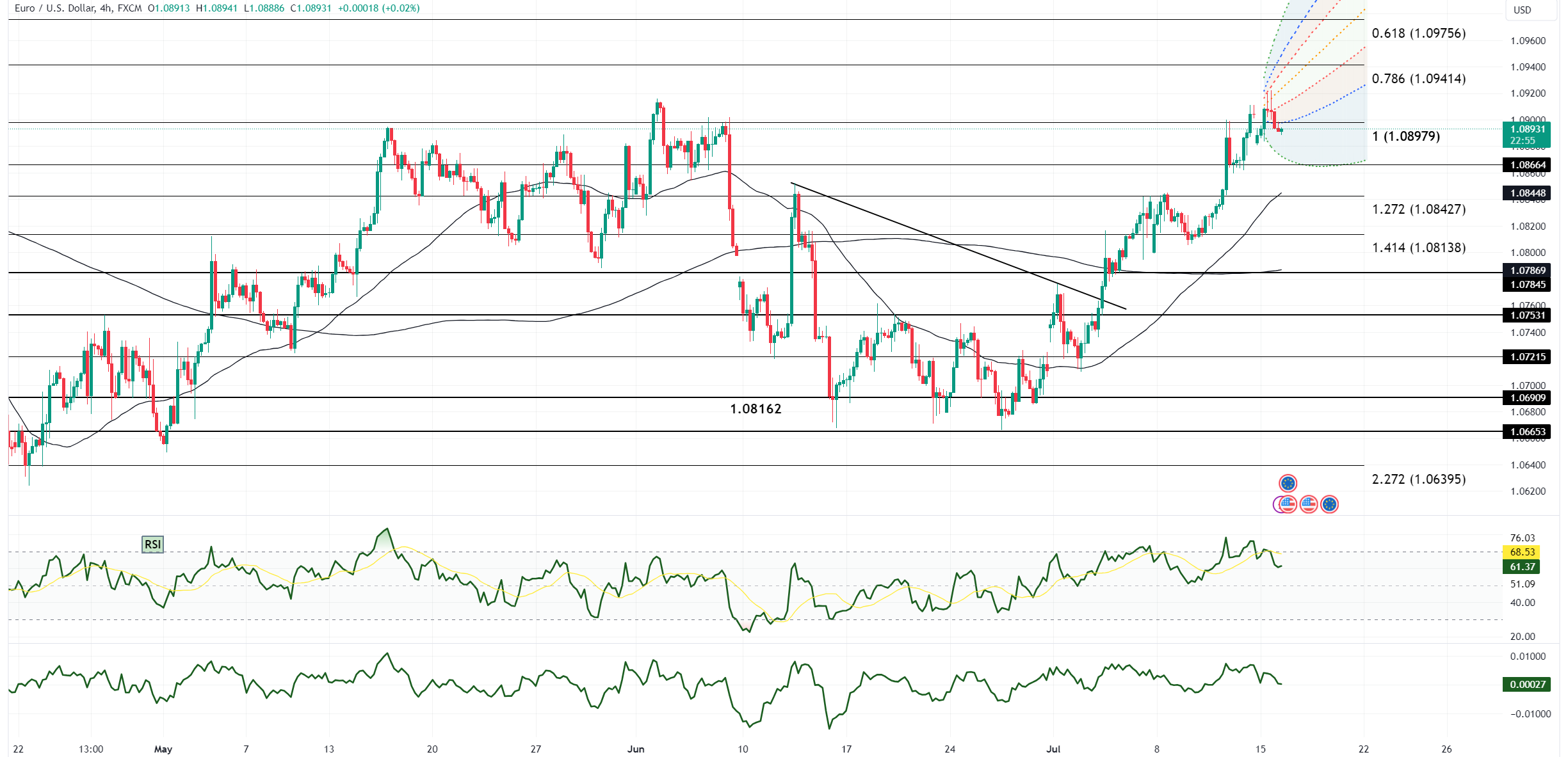

EUR/USD reached a four-month high on Monday but faced investor indecision as the session progressed. The New York session opened near 1.0910 after hitting 1.0881 in Asia, with the initial lift extending due to softer U.S. yields, which helped EUR/USD peak at 1.09225. Gains in equities and gold also weighed on the U.S. dollar, contributing to the euro's strength. However, as Fed Chair Powell spoke, yields firmed and spreads tightened, leading to renewed U.S. dollar buying. This caused USD/CNH to rise, eroding some of the gains in stocks and gold. Consequently, EUR/USD turned lower, sliding below 1.0895 and ending the day down 0.15%. A daily doji formed on the charts, and a divergence in the daily RSI raised concerns for EUR/USD longs, signaling investor indecision. Despite this, monthly technical indicators remain bullish.

EUR/USD's rally to a four-month high is encouraging, but key resistance levels remain, and further gains will likely depend on upcoming U.S. economic data. Reports on U.S. June retail sales and weekly jobless claims will be critical in determining whether the pair's rally continues or if a downward correction ensues. Retail sales are expected to show a decline of -0.3% compared to a 0.1% increase in May, while increases are anticipated for weekly and continuing jobless claims. If retail sales surprise to the downside and jobless claims rise more than expected, U.S. yields could continue their recent downward trend. This scenario may weaken the dollar further, eroding its yield advantage over the euro and potentially clearing resistance near January's -163/-162 basis points spreads.

Tighter spreads and a weaker dollar could combine to propel EUR/USD above the trend line from the 2023 yearly high and the 1.0940/80 resistance, where a series of daily highs from March are located. Technical indicators suggest these barriers are already vulnerable, with rising daily and monthly RSIs that are not yet overbought. A daily bull hammer formed after the day's dip was bought, and the pair remains above the daily cloud and several daily moving averages. A test of the 1.1050/1.1100 resistance area or higher could be in the cards if the data supports further euro strength.

Open an account today to unlock the benefits of trading with CMS Financial