EUR/USD Faces Renewed Downside as Yield Spreads Widen, Growth Outlook Diverges

EUR/USD opened near 1.0830 in New York but quickly lost ground, trading close to the critical 1.0800 level as widening U.S.-German yield spreads and dollar strength took a toll on the pair. The IMF’s revised GDP forecasts highlighted a stark contrast between stronger U.S. growth prospects and weaker eurozone and China outlooks, boosting the dollar. Dovish comments from ECB policymaker Mario Centeno added to the euro’s woes, as he emphasized the risk of inflation undershooting the ECB’s target. With U.S. yields climbing and eurozone rates falling, the yield differential expanded further in favor of the dollar, sending EUR/USD to a fresh two-month low of 1.0801.

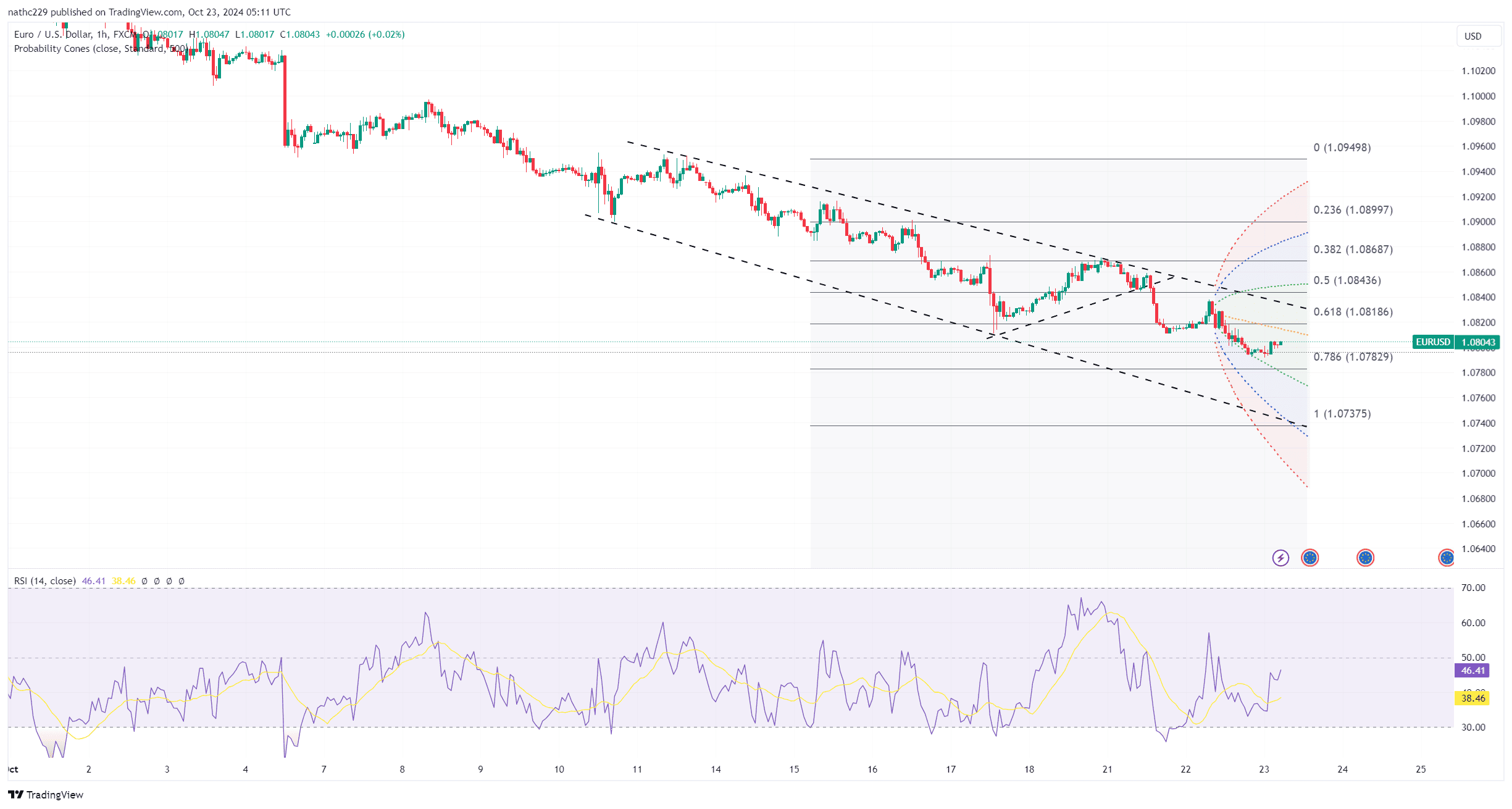

Technically, EUR/USD remains firmly in a bearish trend, with the pair trading below both its 5- and 200-day moving averages. The formation of an inverted hammer candle reinforces the downside risks, as it signals a failure to break above resistance and the potential for further declines. Key support lies in the 1.0775/1.0800 zone, a crucial area that, if broken, could trigger sell stops and intensify the pair’s downward momentum. Falling daily and monthly RSI readings suggest that downward momentum remains strong, and any break below 1.0775 could pave the way for a move toward the 1.0600 support level.

Moving ahead, EUR/USD is likely to remain under pressure as economic divergence between the U.S. and eurozone widens. The dollar’s strength, supported by higher yields and strong economic data, contrasts with the ECB’s dovish outlook and weaker eurozone growth prospects. A break below the 1.0775/1.0800 support zone could spark accelerated selling, with the next downside target around 1.0600. For now, the bearish technical setup, combined with a favorable yield environment for the dollar, suggests that the euro will struggle to recover unless there is a significant shift in sentiment or data.