EUR/USD Drifts Lower as Asian Stock Swings and US Fed Speeches Set the Tone

EUR/USD remained soft, trading down 0.05% during the Asian session, as volatility in regional stock markets dominated price action. The Nikkei plunged 4.65% following a rise in JGB yields, which pushed the Japanese 10-year yield up 6 basis points to 0.86%. Meanwhile, the Shanghai Composite rallied 5.5%, with gains led by China’s property sector after the Politburo signaled more economic support. Despite these divergent risk trends, EUR/USD struggled to break out of its narrow range as investors looked to speeches from ECB President Lagarde and Fed Chair Powell for further guidance on future policy moves.

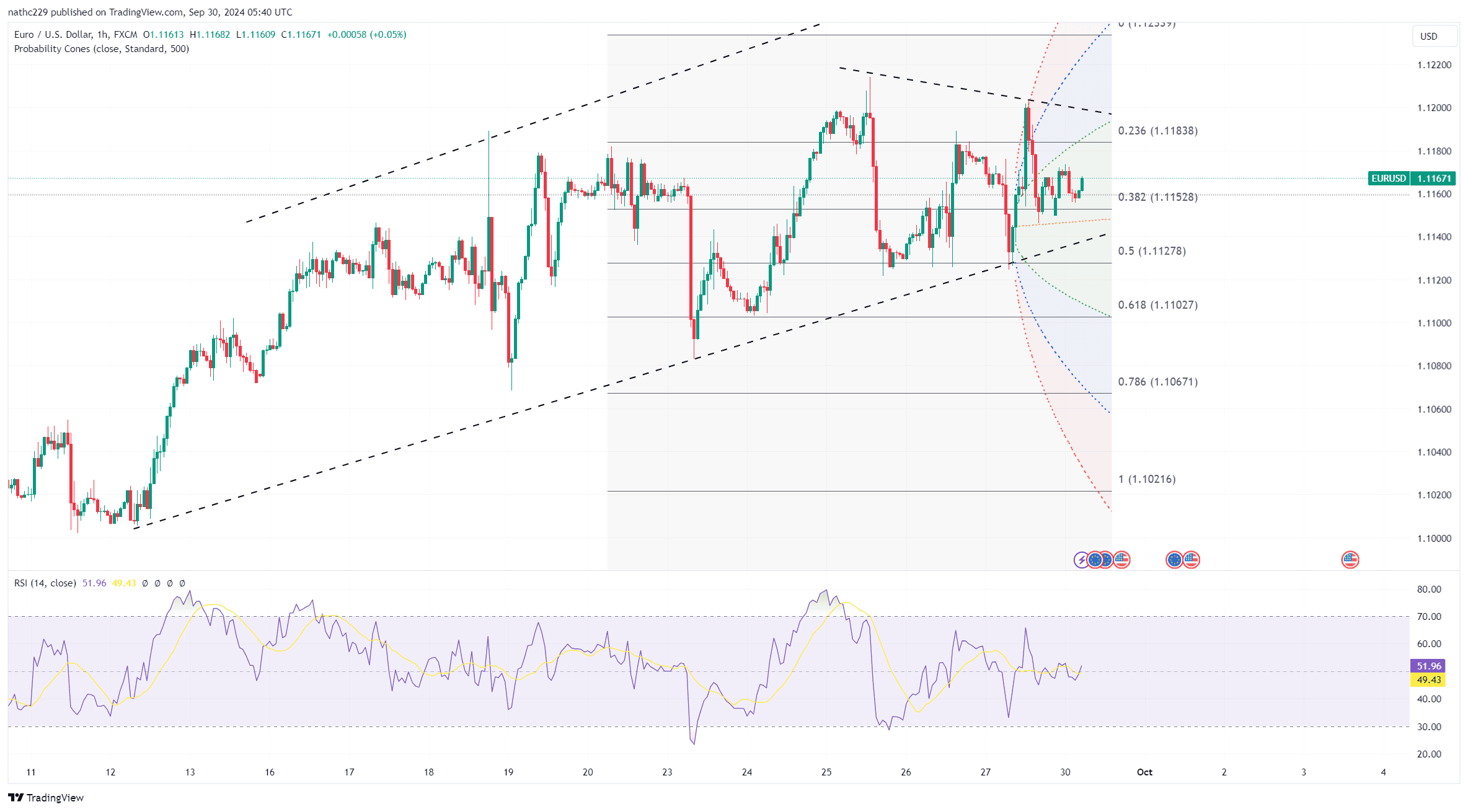

From a technical perspective, EUR/USD remains cautiously bullish, with rising 5, 10, and 21-day moving averages providing support. However, the pair faces stiff resistance near 1.1214, Wednesday’s high, followed by 1.1271, which marks the 61.8% Fibonacci retracement of the 2021-2022 downtrend. On the downside, key support levels include last week's low of 1.1084 and the September 19 base at 1.1068. Traders are also watching large options expiries around the 1.1120/25 and 1.1200 strikes, which could keep price action contained within a tight range, especially as month-end flows come into play.

Looking ahead, a packed U.S. economic calendar, culminating in Friday’s non-farm payrolls report, will be critical for EUR/USD. The market expects 140,000 jobs added in September, with the unemployment rate steady at 4.2%. In addition to Powell’s speech, multiple Fed speakers are set to provide additional context on the U.S. economic outlook, which could drive volatility in EUR/USD. In the eurozone, final September PMIs and inflation data will be key to gauging ECB policy direction. With significant data releases ahead and technical resistance limiting EUR/USD upside, the pair could remain range-bound unless a major surprise in U.S. jobs data prompts a shift in Fed rate expectations.