EUR/USD Drifts Lower Amid US Dollar Strength, Market Prepares for Key Data Releases

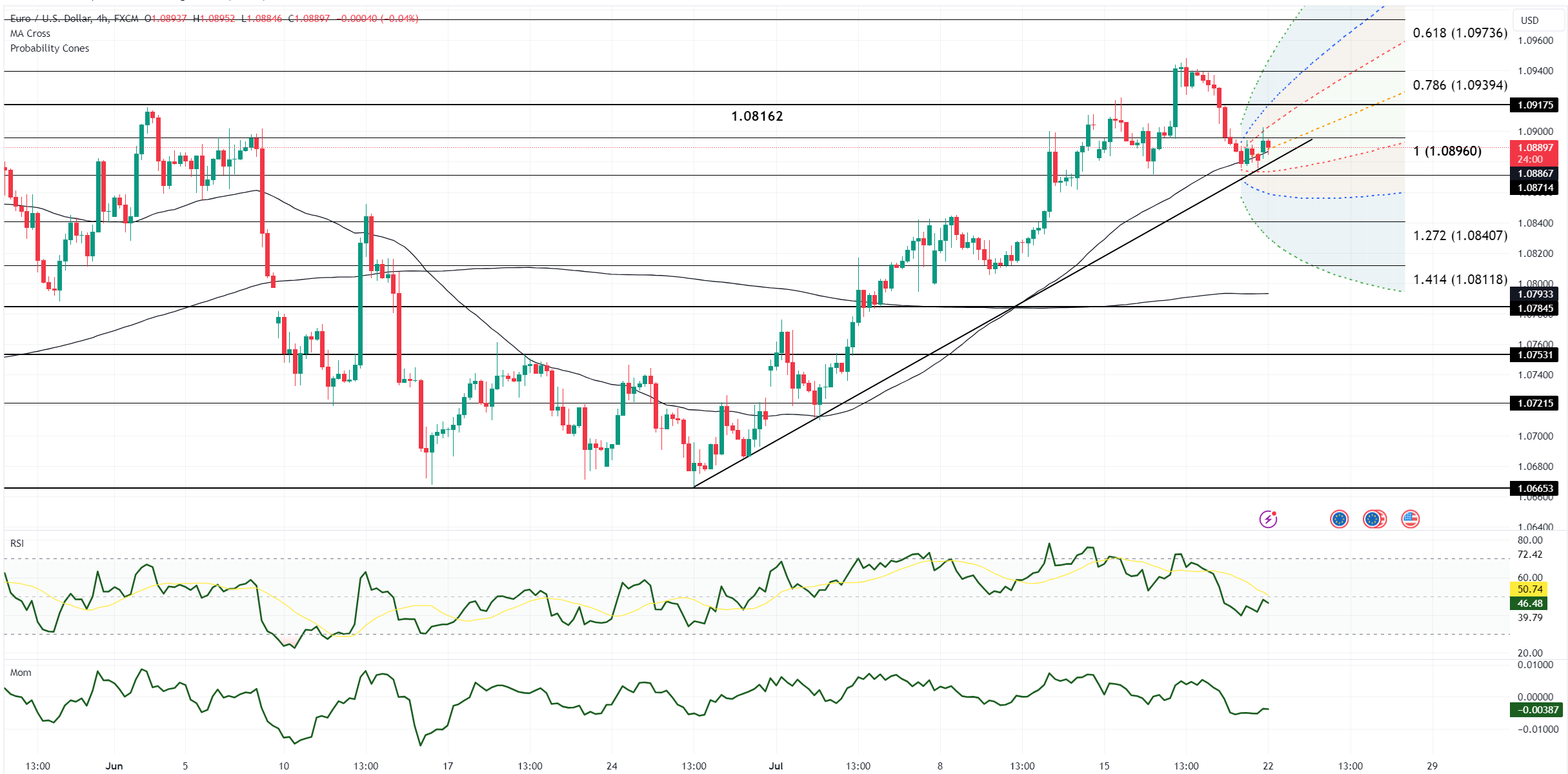

As the weekend approached, EUR/USD was under pressure, with New York opening near 1.0885 after trading between 1.09017 and 1.08760 overnight. An early rally towards 1.0895 faced resistance from sellers, driven by gains in US yields which spurred US dollar buying, and USD/CNH rallied to 7.2865. The DE-US spreads erased earlier tightening, adding further weight on EUR/USD. Falling stock prices and commodity drops also supported the US dollar. EUR/USD dipped below 1.0880, sitting nearby late, trading down -0.11% by the end of the day. Technically, the outlook remains bullish, with consolidation of recent gains, a rising monthly RSI, and support above multiple DMAs and the daily cloud signaling potential upward movement.

On Friday, the dollar strengthened further from recent lows as markets dealt with a tech outage affecting multiple industries, including travel and finance, while investors prepared for key data releases next week, notably the Fed's favorite inflation indicator. The tech issues, stemming from a software update by cybersecurity firm CrowdStrike, boosted the dollar's safe-haven appeal. Investors are keenly awaiting next Friday's PCE release, which could affirm the growing bets on Fed interest rate cuts this year. Although the extreme rate cut expectations have moderated, the futures market still fully prices in two quarter-point reductions this year, with a strong possibility of a third, and foresees 100 basis points of easing by the U.S. central bank by March.

U.S. Treasury yields rose by 4-6 basis points across maturities, with the 2s-10s curve little changed around -27 basis points. The curve, while still inverted, has steepened from -50 basis points in late June, reflecting a greater perceived chance of Donald Trump winning the November presidential election, with all the fiscal, tax, and trade policy implications that could entail.

The S&P 500 fell 0.59% by afternoon trade in New York, extending its sell-off from recent record highs driven by tech stocks and mixed earnings reports, while investors assessed the impact of the cyber outage that affected CrowdStrike's shares. WTI crude oil prices tumbled 3.19% as hopes for a ceasefire in Gaza and a firmer dollar weighed on the market. Copper fell 1.04%, marking its fifth consecutive session of losses and reaching its lowest level in three months due to concerns over the weak Chinese economy and lack of stimulus measures. Gold slid 1.89% as the dollar gained strength and profit-taking ensued after gold reached an all-time peak earlier in the week, fueled by rising expectations of a U.S. interest rate cut in September.

Open an account today to unlock the benefits of trading with CMS Financial