EUR/USD: Diverging Data and Technical Signals Point to Further Downside

EUR/USD turned lower on Friday, striking a five-session low, as diverging economic data and technical indicators suggest continued downside risks. The Eurozone's June HCOB PMI came in below estimates, while the US S&P Global PMI exceeded expectations, causing EUR/USD to trade down for the session and the week. German and US bond yield spreads widened as US PMI data boosted US yields, further supporting the dollar. Late trading in New York saw EUR/USD down 0.10%, ranging between 1.0678 and 1.0697, with the US dollar gaining strength amid a rally in USD/CNH towards 7.2920 and commodity losses driving investors to the safer US dollar.

Key upcoming economic data, such as US weekly jobless claims and May PCE, are expected to be significant risk factors for EUR/USD next week. In Europe, business growth in Germany, France, and the Eurozone slowed sharply in June, with the French services PMI falling into contraction and Germany's manufacturing contraction worsening. This economic deterioration is likely to increase bets on ECB rate cuts, as evidenced by rising Euribor futures prices, and may influence the upcoming elections in France, potentially adding to regional uncertainty.

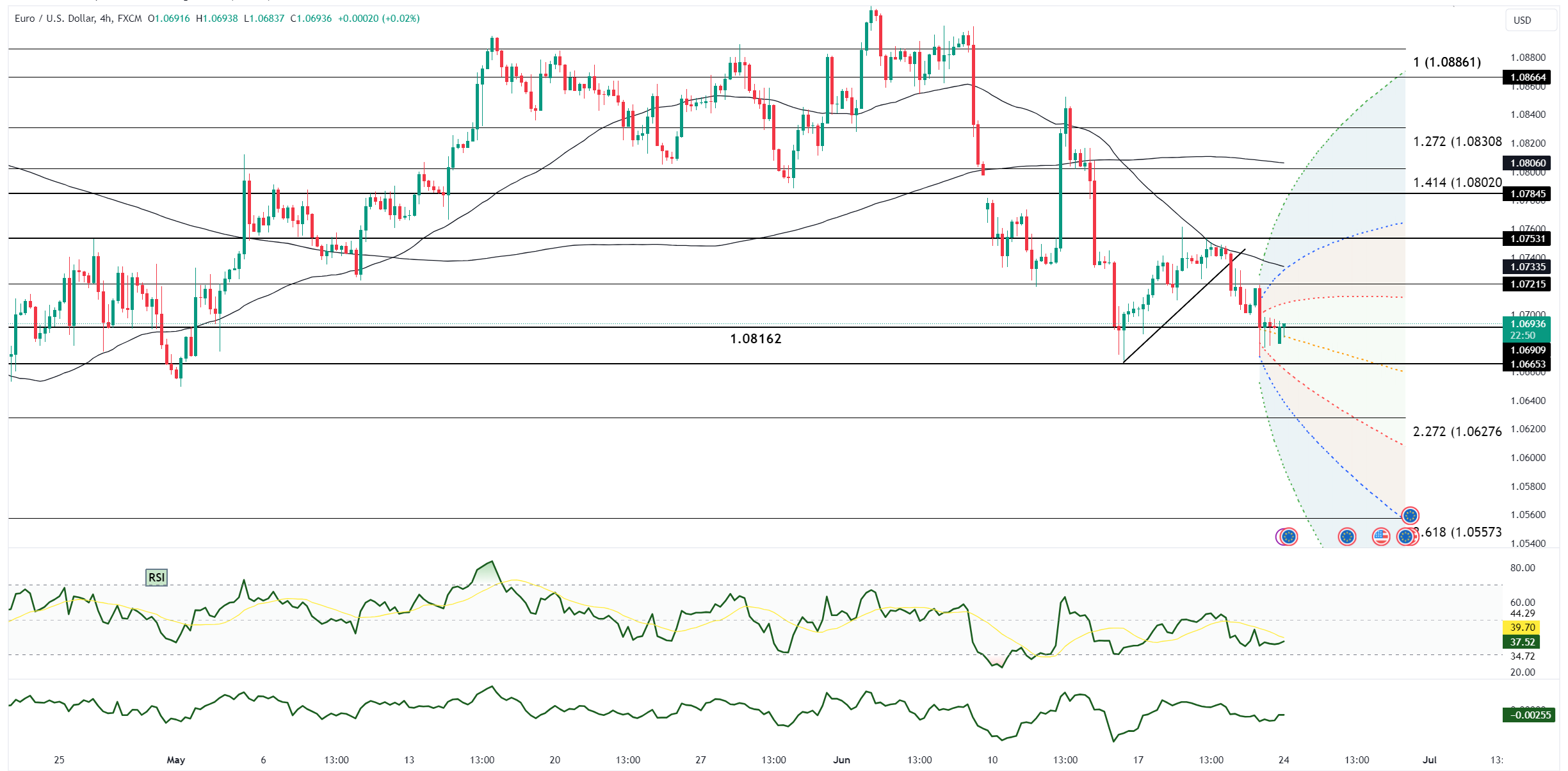

Technical indicators suggest a bearish outlook for EUR/USD. Falling RSIs indicate ongoing downward momentum, and the pair trading below the 10-day moving average (DMA) reinforces this sentiment. The daily and monthly RSIs are not yet oversold, implying room for further downside. The widening German-US two-year yield spread, currently near -194 basis points, is correlated with EUR/USD and is approaching the June 17 wide. Continued poor data and spread widening could further pressure EUR/USD downwards. If EUR/USD breaks below April's low, it could trigger stop-loss selling and potentially lead to a test of the 1.0450/1.0500 zone.

Open an account today to unlock the benefits of trading with CMS Financial