EUR/USD currency pair modestly climbed to 1.0728 after GDP Data

The EUR/USD currency pair has modestly climbed to 1.0728 following the announcement of US GDP figures. The market has reacted positively to strong economic indicators, notably the higher-than-anticipated PCE (Personal Consumption Expenditures) component, signaling a solid economic environment. The pair has been trading within a tight range of 1.0710 to 1.0730, showing restrained trading activity despite the upbeat data.

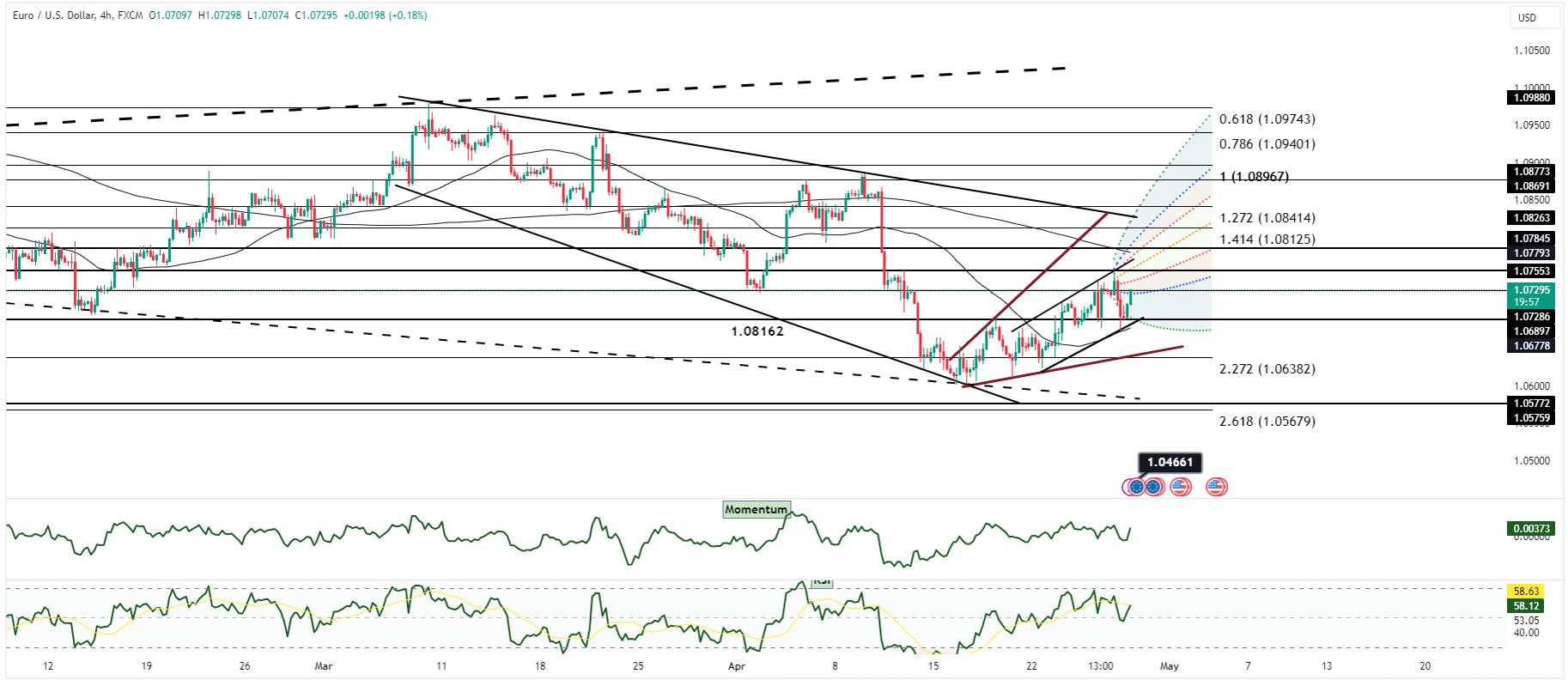

The resistance level at 1.0740, which corresponds to the 61.8% Fibonacci retracement, remains a significant obstacle. A move above this threshold could signal further upward momentum. On the flip side, the 20-day moving average at 1.0660 acts as a crucial support level, with significant buying interest around 1.0680 helping to limit downward risks.

Market sentiment is moderately optimistic with 55% of participants expressing a positive outlook, likely swayed by the favorable GDP data and its implications for the resilience of the U.S. economy. However, 25% hold a pessimistic view, and 20% are neutral, indicating some uncertainty and caution among market participants. This varied sentiment highlights the market's careful consideration of potential shifts in economic interpretation and upcoming economic events, such as the Federal Reserve's interest rate decisions.

The impending decision on interest rates by the Federal Reserve could notably influence this market dynamic. Should the Fed adopt a hawkish tone in response to stronger economic data, it could strengthen the dollar, potentially driving the EUR/USD lower despite current positive sentiment. Conversely, a dovish stance could weaken the dollar, offering an opportunity for the EUR/USD to surpass the current resistance level. Therefore, traders and analysts are keenly awaiting the Fed's comments for indications of future monetary policy direction.