EUR/USD Bears Eye 1.1000 as Yield Differentials and Disinflation Weigh on the Euro

EUR/USD fell to a fresh three-week low on Tuesday, pressured by widening yield differentials between the U.S. and Germany and weaker-than-expected euro zone inflation data. The pair opened near 1.1090 in New York trading, but it quickly lost ground as the widening U.S.-German yield spread, fueled by firm U.S. economic reports such as the ISM manufacturing PMI and August JOLTs, boosted the dollar. At the same time, the euro struggled with the implications of euro zone inflation data, which indicated that disinflation is taking hold, raising concerns that the European Central Bank (ECB) may shift its focus from inflation to growth in the coming months. Geopolitical tensions further added to the risk-off sentiment, prompting a flight into safe-haven assets and pressuring the euro further.

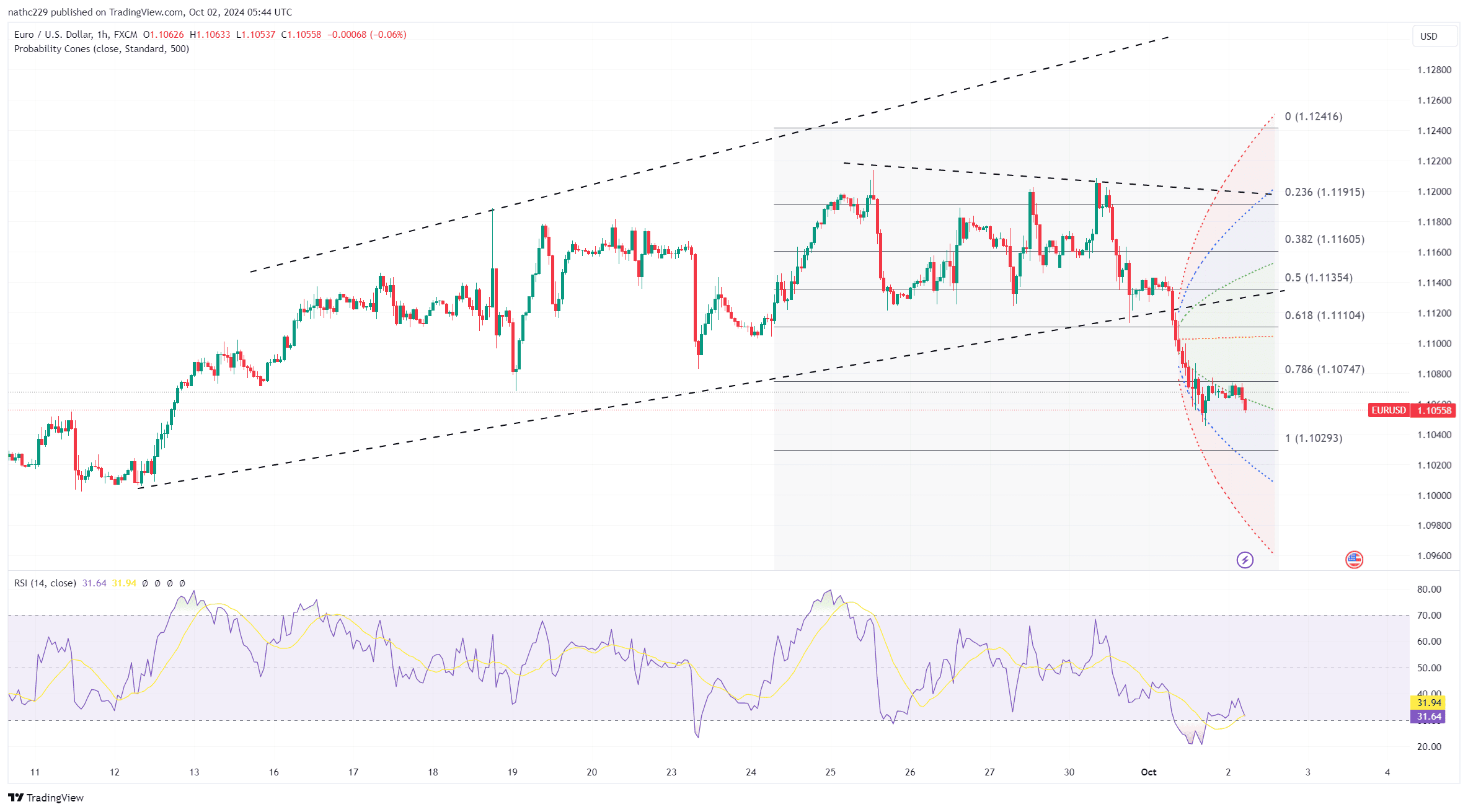

Technically, EUR/USD is leaning bearish, with the pair falling below its 5- and 21-day moving averages, signaling a shift in momentum. The next key level of support lies near the psychological 1.1000 mark, which, if broken, could trigger a larger downside move. The potential completion of a double top pattern points toward a target of 1.0785/1.0800, a key support zone representing the measured move from the pattern’s top to bottom. With RSIs falling and the broader market sentiment favoring the dollar due to U.S. yield advantages, the bearish outlook for EUR/USD remains intact, particularly if euro zone data continues to underwhelm.

Looking ahead, the focus shifts to upcoming U.S. economic data and commentary from Federal Reserve officials. Wednesday’s ADP employment report and speeches from Fed policymakers, including Hammack, Musalem, Bowman, and Barkin, will be crucial for shaping market expectations. Additionally, with geopolitical tensions remaining high, the safe-haven demand for the dollar could keep EUR/USD under pressure. Should the euro zone’s weak growth and disinflation persist, the ECB may consider more aggressive rate cuts, further widening the policy gap with the Fed and driving EUR/USD toward the 1.0800 level. A sustained break below 1.1000 could confirm the pair’s downward trajectory.