Every time you open your trading platform, you see live prices flashing for EUR/USD, GBP/JPY, XAU/USD and dozens of other instruments.

Behind those numbers is a simple structure that tells you what you can buy or sell, at which price, and how much it may cost you.

Bid / ask / spread

Pips & volatility

Cross & exotic pairs

Technology & news

1. What Exactly Is a Forex Quote?

A forex quote is a real-time exchange rate between two currencies. It tells you how much of one currency

you need to spend to obtain one unit of another. Quotes are always shown as a pair, such as EUR/USD or USD/JPY.

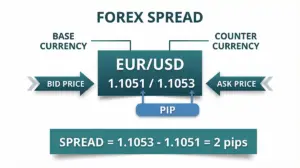

When your terminal shows EUR/USD at 1.1051 / 1.1053, it means:

- You are looking at the price of one euro expressed in US dollars.

- You can sell at 1.1051 (bid) or buy at 1.1053 (ask).

- The difference between the two prices is the broker’s spread.

2. Breaking Down a Live Quote

Every price you see on your platform is built from four core elements.

Understanding these is the starting point for any trading strategy.

2.1 Base and Quote Currency

A pair consists of:

- Base currency – the first currency in the pair (EUR in EUR/USD).

- Quote (or counter) currency – the second currency (USD in EUR/USD).

The quote tells you how many units of the quote currency you need to buy one unit of the base currency.

If EUR/USD = 1.1053, you pay 1.1053 USD for 1 EUR.

2.2 Bid, Ask and Spread

Markets always quote two prices:

- Bid price – the price at which you can sell the base currency.

- Ask price – the price at which you can buy the base currency.

- Spread – the difference between the two, often measured in pips and representing your direct trading cost.

2 pips in your favor just to cover that cost.

2.3 Pips and Price Steps

A pip is the standard unit used to describe small price changes in forex.

For most pairs, one pip is the fourth decimal place (0.0001).

For JPY pairs, it is usually the second decimal place (0.01).

Many brokers also show a “fractional” digit (a tenth of a pip), which helps scalpers and algorithmic

systems react to very small changes.

3. From Pip Value to Position Size

Pip values are important because they translate price movements into money gained or lost.

The pip value depends on the pair, the size of your position and the account currency.

- For a standard lot (100,000 units) where USD is the quote currency (e.g., EUR/USD), one pip is usually about $10.

- For a mini lot (10,000 units), one pip is roughly $1.

- For micro lots (1,000 units), one pip is around $0.10.

When USD is not the quote currency, the pip value must be converted, but modern platforms handle that automatically in the background.

4. Major, Cross and Exotic Pairs

Not all currency pairs behave the same way. Liquidity, volatility and costs can vary dramatically between them.

| Pair Type | Typical Example | Characteristics |

|---|---|---|

| Major | EUR/USD, GBP/USD, USD/JPY | Highest liquidity, relatively tight spreads, usually lower trading costs. |

| Cross | EUR/GBP, EUR/AUD, GBP/JPY | No USD in the pair, spreads usually a bit wider, moves often influenced by both related majors. |

| Exotic | USD/TRY, USD/ZAR, EUR/PLN | Lower liquidity, wider spreads, potentially sharp moves during news or low-liquidity sessions. |

5. Why Live Quotes Move All the Time

If you watch a price feed for a few seconds, you will notice quotes constantly updating.

That movement is driven by a combination of economic data, global events and overall market sentiment.

5.1 Economic Releases

Scheduled news – such as inflation reports, GDP figures, employment data or central bank decisions – can

cause sudden jumps in quotes. Traders use economic calendars to prepare for these events and adjust their risk.

5.2 Geopolitics and Global Risk Mood

Elections, wars, trade agreements and unexpected political headlines can all trigger re-pricing of currencies.

In risk-off environments, investors may move into so-called “safe-haven” currencies like USD, JPY or CHF,

which immediately shows up in live quotes.

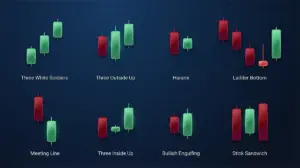

5.3 Technical Factors

Even without fresh news, prices react to technical levels that many traders watch: support, resistance,

trend lines and chart patterns.

to interpret quote history. Source: assets.topbrokers.com

6. Technology Behind Live Forex Quotes

Modern quotes are the result of a complex data pipeline that connects banks, liquidity providers,

ECNs and retail brokers. For the end-user, this shows up as a simple streaming price on a screen.

6.1 From Liquidity Providers to Your Platform

Large banks and institutional market-makers submit their bid and ask prices to liquidity pools.

Brokers and ECNs aggregate those feeds, usually taking the best bid and best ask

available at each moment, then stream the combined quote to clients.

The quality of your quotes will depend on:

- How many liquidity sources your broker connects to.

- The speed and stability of their infrastructure.

- How they handle mark-ups, commissions and execution.

6.2 Mobile Platforms and Notifications

Mobile trading apps allow you to monitor live quotes without staying at a desk.

Push notifications can alert you when:

- A price reaches your predefined level.

- Key economic releases are due.

- Your open positions hit stop-loss or take-profit levels.

6.3 Algorithms, HFT and Smart Order Execution

Algorithmic systems and high-frequency trading (HFT) engines constantly scan quote streams looking

for tiny inefficiencies, arbitrage and momentum. While these tools are mostly institutional,

retail traders indirectly benefit from tighter spreads and faster execution that such competition brings.

Source: assets.topbrokers.com

7. Reading Quotes Inside a Trading Strategy

Knowing what a quote means is one thing; using it in a trading plan is another.

Here are a few ways traders combine live prices with analysis.

7.1 Trend and Pattern Analysis

Historical quotes form the basis for chart patterns, trend lines and moving averages.

Traders try to identify whether a market is:

- Trending higher (series of higher highs and higher lows).

- Trending lower.

- Ranging within a horizontal channel.

Source: assets.topbrokers.com

7.2 Volatility and Risk Management

Indicators such as Average True Range (ATR) help measure how far a pair typically moves during a given period.

Higher ATR values usually mean wider swings and the need for more generous stop-loss levels.

Combining volatility with pip value and position size allows you to decide:

- How large your trades should be.

- Where to place stop-loss and take-profit orders.

- How many positions you can safely hold at the same time.

8. Key Takeaways for Everyday Trading

- Every quote is a compact message: base/quote, bid, ask and spread.

- Pips describe tiny price moves, but with leverage they translate into meaningful profit or loss.

- Majors are typically cheaper to trade, while exotics can be volatile but more expensive.

- Economic news, politics and overall risk sentiment constantly reshuffle live quotes.

- Modern technology – from liquidity aggregation to mobile apps – makes real-time pricing available to anyone with an internet connection.

- To use quotes effectively, combine them with solid risk management and a clear, tested strategy.

Live forex quotes may look like random numbers at first glance, but once you understand how they are constructed and what moves them,

they become a powerful tool for making informed trading decisions.